Singapore’s VCC is Powering the City-State’s Global Fund Leadership

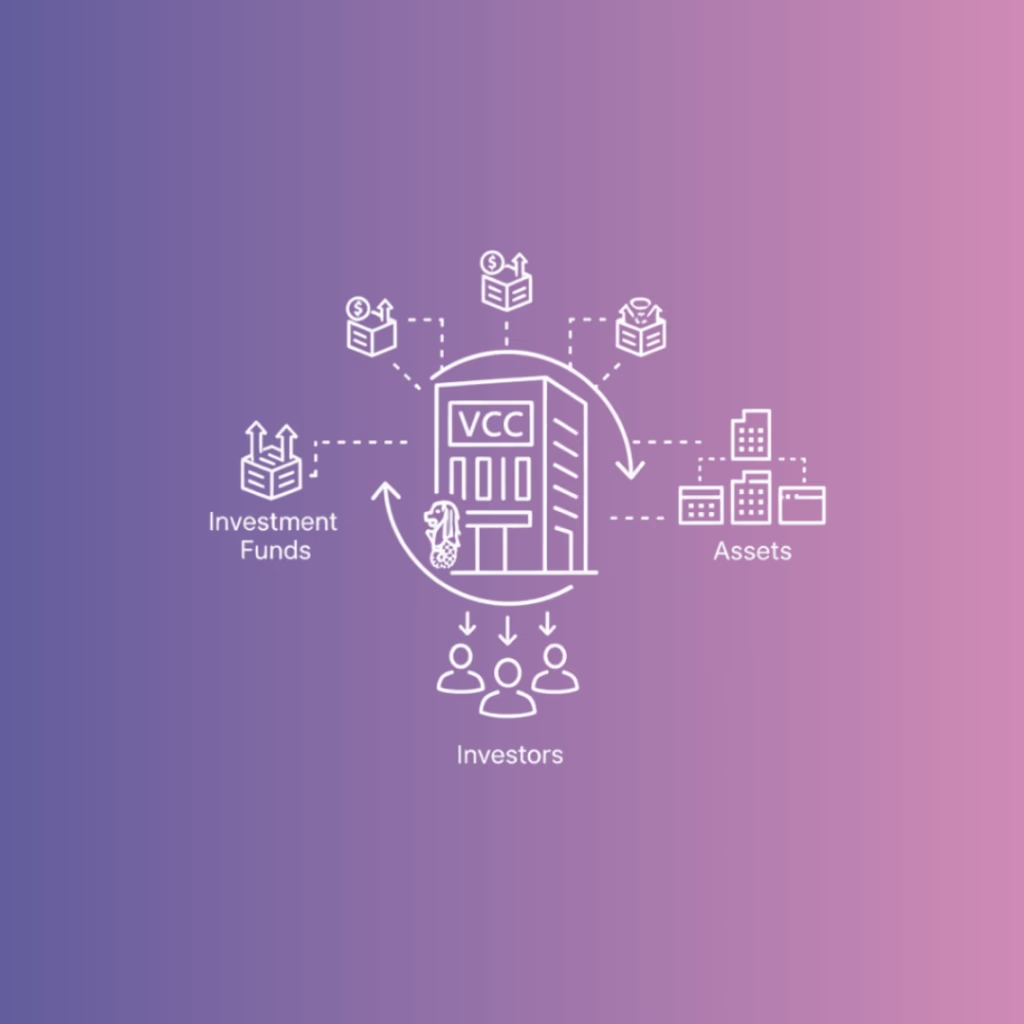

Singapore is setting the pace and keeping up with global fund innovation. At the heart of this evolution is the VCC fund structure, a modern framework built for flexibility, speed, and global reach. Backed by a strong regulatory foundation and MAS support, the Variable Capital Company (VCC) gives fund managers the freedom to scale while […]

How Much Does It Cost to Launch a Singapore VCC and How Long Does It Take

Launching a fund in one of Asia’s most trusted financial hubs, Singapore, comes with a powerful advantage: the Variable Capital Company (VCC). This flexible fund structure is quickly becoming the go-to for fund managers and investors who want a cost-efficient and globally respected base. From competitive setup costs to investor-friendly regulations, the VCC ticks all […]

5 Key Benefits of Setting Up a Singapore Variable Capital Company (VCC)

A game-changing corporate structure has emerged in the Asia-Pacific fund landscape: the Singapore Variable Capital Company (VCC). Introduced under the Variable Capital Companies Act in January 2020, this forward-looking framework was designed to strengthen Singapore’s fund management ecosystem by offering a more flexible, tax-efficient investment vehicle tailored for professional investors. If you’re new to the […]