Singapore is setting the pace and keeping up with global fund innovation. At the heart of this evolution is the VCC fund structure, a modern framework built for flexibility, speed, and global reach.

Backed by a strong regulatory foundation and MAS support, the Variable Capital Company (VCC) gives fund managers the freedom to scale while staying anchored in one of the world’s most trusted jurisdictions.

In this article, we explore how the VCC fund structure is powering Singapore’s rise as a global fund leader, from its policy vision and market momentum to its growing pull among international fund managers.

Singapore’s Ascent as a Global Fund Hub

Singapore’s evolution into a global fund hub is the product of deliberate strategy, institutional trust, and a long track record of policy consistency. The city-state’s stable governance, deep tax treaty network, and pro-business environment have long anchored its role in cross-border finance.

Building on that foundation, regulators introduced the VCC fund structure, a flexible, modern vehicle designed to rival traditional domiciles like the Cayman Islands or Luxembourg.

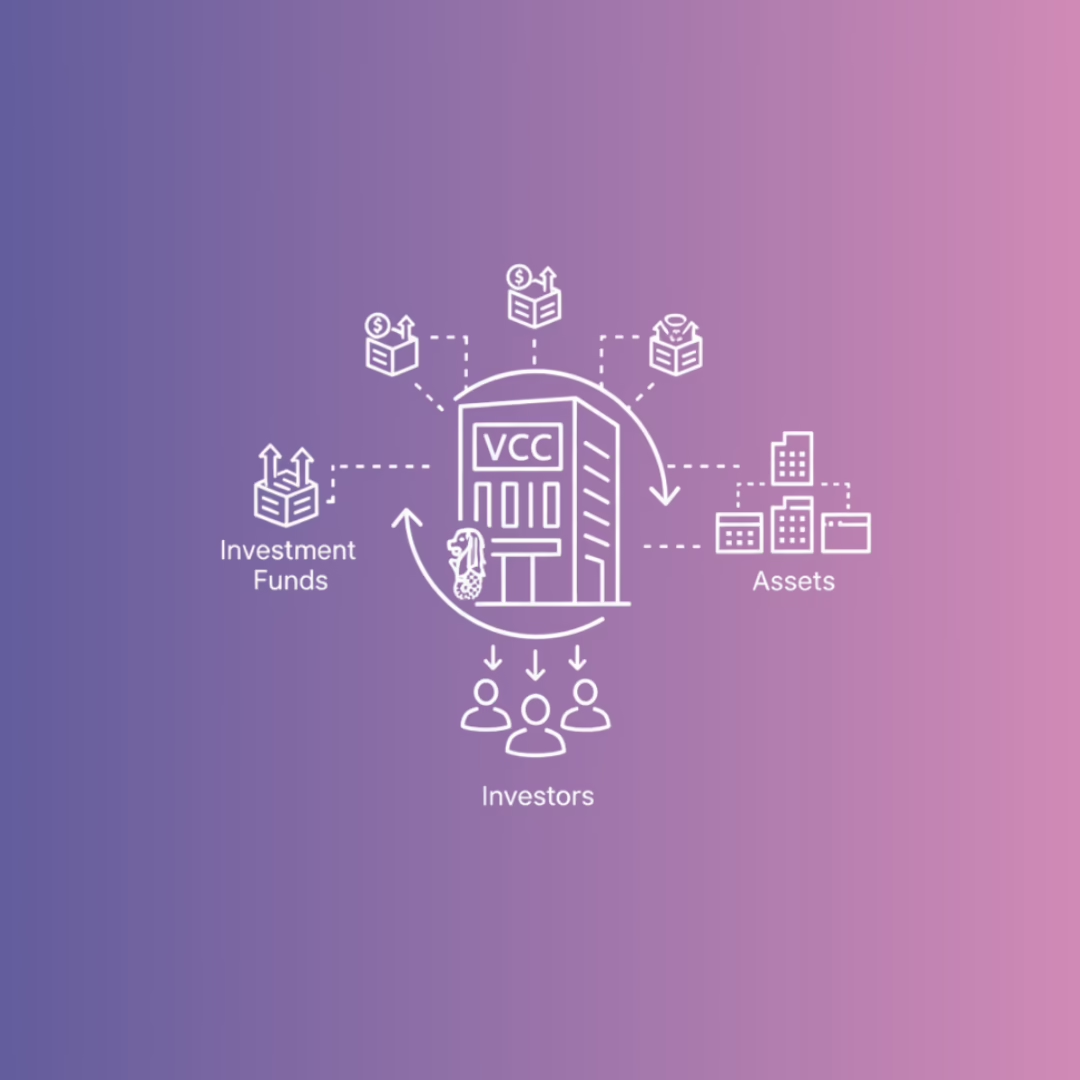

Unlike older structures such as limited partnerships or unit trusts, the VCC doesn’t replace Singapore’s existing fund models. It complements them by adding a structure purpose-built for pooled investment activity, with regulatory oversight jointly managed by MAS and ACRA, ensuring fund managers and investors operate under predictable, transparent conditions.

In fact, as PwC noted, “Creating VCCs as an umbrella structure allows for the pooling of investors. Such pooling enhances efficiency by removing the need for additional administrative layers across fund structures.”

By late 2024, over 1,200 VCCs had been incorporated or re-domiciled in Singapore across diverse investment strategies, a clear sign that global fund teams now see Singapore not as an emerging alternative, but as a core domicile for serious capital deployment.

VCC as the Structural Innovation Powering Singapore’s Fund Ecosystem

Built to remove friction from fund management, the VCC fund structure gives fund managers operational agility and scalability from day one. It allows shares to be issued or redeemed at net asset value without requiring shareholder approval, creating flexibility for investor entry and exits.

Its umbrella framework supports multiple sub-funds within a single legal entity, each with ring-fenced assets and liabilities. This structure reduces administrative duplication across governance, reporting, and service providers while maintaining a clear separation between strategies.

VCCs also enjoy accounting flexibility, with the option to use IFRS, US GAAP, or Singapore FRS (Financial Reporting Standards), along with a clear legal pathway for re-domiciling foreign funds into Singapore. For fund managers, understanding the launch timelines and setup costs of the structure can be a practical next step.

As ACRA affirms in its official setup guide, these features are core to Singapore’s push to build a globally competitive and efficient fund ecosystem.

In short, the VCC blends flexibility with institutional-grade governance. Its adaptable share structure, umbrella architecture, and alignment with international standards are part of what makes it both credible and investor-friendly, solidifying these benefits of a Singapore VCC as a cornerstone of the city-state’s ascent as a global fund hub.

Setting up under the VCC fund structure? Talk to us to simplify your fund launch and get started with confidence.

Investor Transparency and Governance

To win investor confidence, Singapore’s VCC regime layers in substantial governance:

Robust AML / KYC and compliance

Every VCC operates under Singapore’s strict AML and counter-terrorism financing standards. Fund managers must perform customer due diligence, ongoing monitoring, and report suspicious transactions. This level of transparency builds confidence among institutional investors and aligns Singapore with leading global fund jurisdictions.

Mandatory audits and disclosures

Each VCC must prepare audited financial statements in accordance with recognized accounting standards. These disclosures provide investors with clear, verified insights into fund performance, operational soundness, and risk management practices—key indicators of institutional maturity.

Local substance and director requirements

To strengthen governance and accountability, the VCC Act requires resident directors and a meaningful local presence, depending on the scheme type. This ensures that Singapore functions as a genuine fund domicile rather than a “letterbox” jurisdiction, reinforcing its reputation for credibility and investor protection.

These features help position Singapore’s VCC fund structure as trustworthy not only in name, but in practice.

Global Fund Managers and the Shift Toward Singapore

The adoption of VCCs is no longer limited to regional players. Global fund managers and family offices are making the shift. Many legacy funds based in the Cayman Islands, BVI, or Luxembourg are now re-domiciling or launching parallel VCCs in Singapore to capture the advantages of an “onshore plus flexibility” model.

Singapore’s blend of regulatory certainty and a fast-evolving private markets ecosystem positions it as a strategic bridge between East and West. By leveraging Singapore’s transparent regulatory ecosystem and tax treaty network, managers can operate closer to Asian LPs and regional deal flow while maintaining international standards. The shift signals a clear evolution in fund domiciliation, from offshore complexity to onshore efficiency.

Policy Backing and MAS Support Strengthening Singapore’s VCC Framework

The Monetary Authority of Singapore (MAS) has deliberately shaped policy and ecosystem initiatives that position the VCC fund structure at the center of its asset management strategy.

MAS has pushed for both fund re-domiciliation and ecosystem readiness, ensuring that managers can move their structures onshore without friction. One of the most notable initiatives is the VCC Grant Scheme, which co-funds qualifying setup or re-domiciliation expenses.

This incentive directly supports early adoption and encourages fund managers to leverage the VCC’s flexibility, cost efficiency, and tax advantages.

Long-Term Investment Funds (LIFs) and Private Market Growth

As of March 2025, MAS is developing a new framework for Long-Term Investment Funds (LIFs), designed to enable retail investors to participate in private market opportunities that were previously exclusive to institutions. By widening access to private markets, Singapore is shaping a more inclusive and resilient asset management ecosystem.

These initiatives sit within MAS’s broader strategy to strengthen Singapore’s position as a global center for asset management and deepen its private markets infrastructure. Fund managers benefit from the credibility of MAS oversight, the efficiency of local service providers, and the global recognition of Singapore’s regulatory standards.

Singapore’s regulatory culture has become a benchmark in the region. Its leadership in anti-money laundering (AML) and counter-financing of terrorism (CFT) frameworks reinforces the country’s reputation for transparency and strong governance.

Alignment with Financial Action Task Force (FATF) and Organisation for Economic Co-operation and Development (OECD) standards signals a consistent commitment to a well-supervised and trusted financial environment that continues to attract global investors.

Final Thoughts

The VCC fund structure has become the backbone for fund managers building scalable, efficient, and credible platforms across Asia. The value exchange is clear: commit to substance and transparency, and gain the flexibility, efficiency, and structural coherence of a unified vehicle.

If Singapore is part of your 2025 fund strategy, start with the fundamentals. Align your legal, tax, custody, and audit framework early. Don’t chase features, build an operational foundation that lets the VCC do what it’s designed for: compounding efficiency and unlocking cross-strategy leverage.

Ready to explore your next fund setup in Singapore? Book a call with us or get in touch with us at info@auptimate.com, and one of our experts will be more than happy to help.