In the modern fund structure landscape, flexibility, credibility, and efficiency matter, and that’s where the Singapore VCC (Variable Capital Company) comes to play, combining the sophistication of a regulated vehicle with the agility that fund managers, syndicate leads, and family offices need to operate globally.

In this article, we’ll uncover what a VCC is, how it works, who typically uses it, and why this framework was launched, giving you clarity on the context of Singapore’s fund ecosystem.

What Is a Variable Capital Company (VCC)?

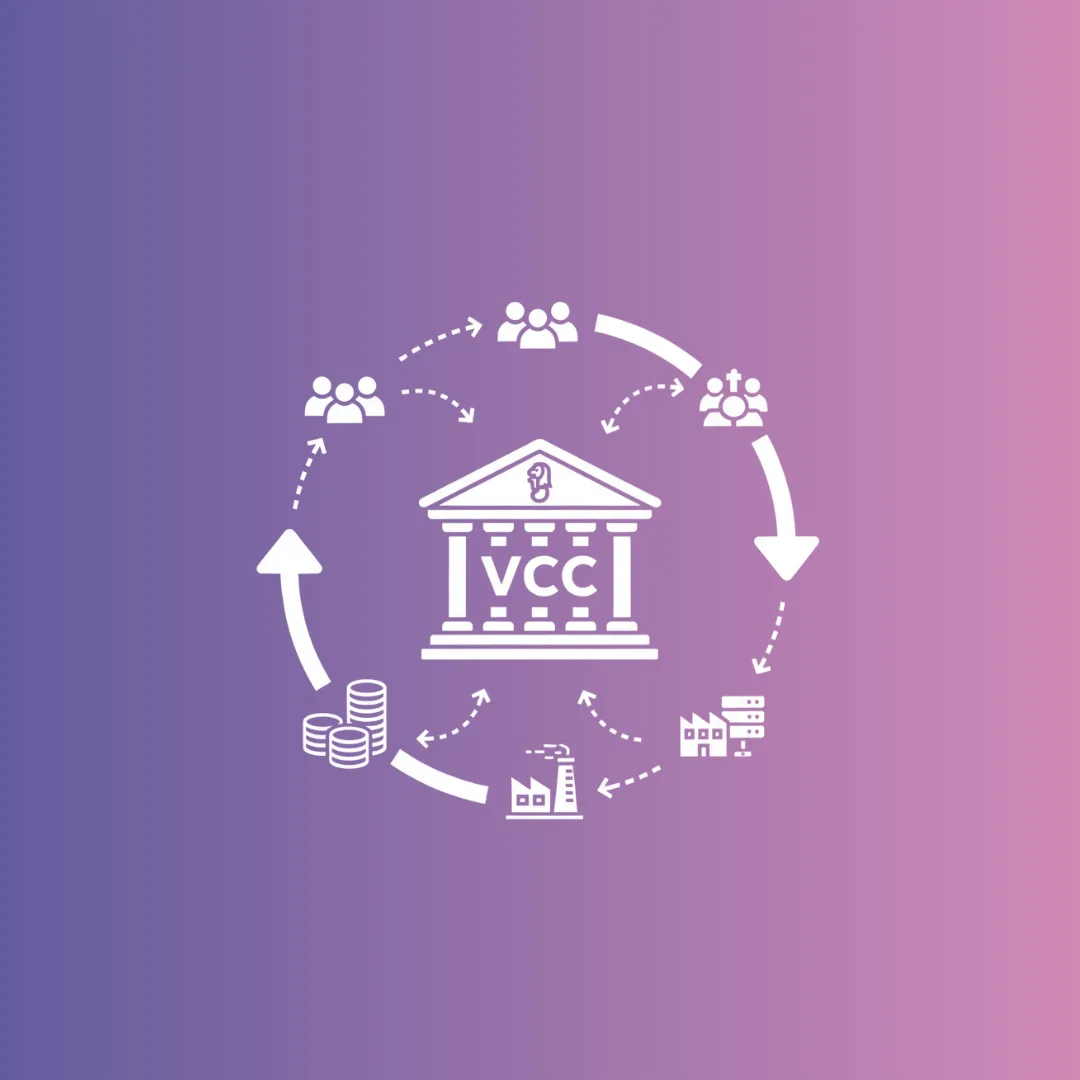

A Variable Capital Company (VCC) in Singapore is a fund-friendly corporate wrapper that allows fund managers to create a single or umbrella fund with multiple segregated sub-funds, and it works for both open-ended and closed-end fund strategies. This structure is made under the Variable Capital Companies Act 2020.

In short, it’s a single legal entity with many sub-funds, clear segregation and simpler admin. The framework was designed to boost Singapore’s status as a global fund centre by delivering greater efficiency, greater flexibility and greater privacy.

A VCC fund in Singapore is like a building that is flexible enough to hold multiple “rooms” (sub-funds) under one legal roof. Imagine you’re setting up an investment fund in Singapore, and instead of creating a new standalone entity for each strategy launch, you make a “parent” vehicle with multiple “rooms.” Each room has its own assets, investors and rules, but they all share the same legal roof, board and admin team.

How the VCC Structure Works

A VCC fund in Singapore is designed for adaptability and operational efficiency and built to simplify fund administration.

Here’s how each part of the VCC framework comes together in practice.

- Setting Up

A licensed fund manager is appointed to handle both day-to-day operations and investment management, ensuring compliance with MAS regulations from the start.

- Investing

Investors can buy shares in the overall VCC or directly into a specific sub-fund that fits their strategy. Their capital is then pooled and distributed into the fund’s chosen investments, giving them access to a professionally managed, flexible vehicle without the administrative drag of traditional structures.

- Operations

Once the fund is active, the appointed manager executes its investment strategy and manages performance. In the case of umbrella VCCs, a board oversees all sub-funds, each with its own portfolio, accounts, and liabilities, so activities in one sub-fund don’t impact another.

- Redemption

When investors are ready to exit, they simply redeem their shares. The VCC’s capital is adjusted accordingly; no shareholder vote is required. This seamless redemption process is one of the most significant advantages of the VCC fund framework in Singapore. It provides investors with liquidity without the bureaucratic hurdles common in traditional corporate setups.

Behind these setups, governance remains professional, with the VCC at the top, a board overseeing, and a licensed fund manager handling investments. Additionally, administrators, custodians, and auditors all seamlessly fit into the structure.

Who Typically Uses a Singapore VCC

If you’re a fund manager, a syndicate lead, a family office, or a private bank, and you’re thinking about an investment vehicle structure, then considering a VCC fund in Singapore makes a lot of sense.

Boutique firms and large institutions: Smaller firms like boutique managers use VCCs for niche strategies. Large institutions leverage them because they can support multiple sub-funds under one roof.

Family offices: Family offices are drawn to the umbrella model because it allows them to set up sub-funds for different family members, with separate investment strategies and even geographies, while consolidating governance and cost infrastructure.

Institutional investors/asset owners: Pension funds, insurance companies and sponsors use VCCs to pool assets efficiently, appoint a fund manager and focus on their core business rather than building a fund structure from scratch.

Syndicate leads and angel groups: While many syndicate leads still prefer a single-deal SPV, a VCC setup becomes attractive for its multi-deal structures, pooled capital and repeat investments across strategies.

Why Singapore Introduced the VCC Framework

In a fast-paced world where fund structures matter, Singapore adapted. The Monetary Authority of Singapore (MAS) and the Accounting and Corporate Regulatory Authority (ACRA) rolled out the VCC regime to position the city-state as a future-proof fund domicile.

According to ACRA, “The VCC will complement the existing suite of investment fund structures available in Singapore,” strengthening fund redomiciliation and enhancing Singapore’s role as a competitive, tax-efficient jurisdiction for investment vehicles.

Here are the core drivers:

- Global competitiveness – Singapore sought to compete with the Cayman Islands, Luxembourg, and Ireland by offering a modern fund vehicle.

- Operational flexibility – Variable capital, umbrella/sub-fund architecture, share issuance/redemption freedom.

- Cost and admin efficiency – Fewer standalone vehicles, shared service infrastructure, one legal entity.

- Attracting offshore funds and redomiciliation – Overseas funds can transfer their VCC structure into Singapore, benefiting from local tax treaties, a robust regulatory regime, and access to Asian investors.

Ready to streamline your fund strategy using a Singapore VCC? Talk to our expert to see how your structuring can move faster and leaner across Asia.

Is the VCC Right for You?

A VCC fund in Singapore suits you if you’re looking for a flexible, efficient, globally credible investment vehicle. Here are some scenarios where it works best:

- You’re launching multiple sub-funds under shared governance.

- You’re managing both open-ended and closed-end strategies, or moving from one to another.

- You want cost-efficient pooling with ring-fencing between funds.

- You’re seeking access to Singapore’s fund ecosystem, tax treaties and Asia-Pacific investor base.

- You are a syndicate lead, family office or fund manager managing numerous strategies and want a single platform rather than building many discrete vehicles.

On the other hand:

- If you’re running a single-deal SPV with limited investors, a simpler structure may suffice.

In a nutshell, the VCC fund in Singapore is a strong fit when scale, complexity, pooling and flexibility matter but less so when the fund is one-off, small and narrow in scope.

Final Thoughts

The Singapore VCC structure is a strategic instrument for fund managers, syndicate leads, family offices and asset owners looking to leverage Asia’s growth, reduce structural complexity and build a scalable platform. With variable capital, umbrella structure, and Singapore’s fund incentives, a VCC fund in Singapore puts you in a strong position.

If you’re exploring fund formation in Singapore or building a flexible vehicle structure for global or regional investing, book a call with us or get in touch with us at info@auptimate.com, and one of our experts will be more than happy to help.