Where Asian Private Markets are Headed this 2026

Asia’s private markets trend for 2026 is shaping up to be both a rebound and a redesign. Liquidity is expanding, but it no longer flows only through IPO lanes but instead, private credit, secondaries and hybrid fund structures now shape outcomes. GPs, family offices and allocators who move fast on structure, liquidity engineering and cross-border […]

What the Surge in Secondary Transactions Reveals About Investor Strategy

While the slow grind of the exit market may be over, it’s not because of the IPO’s comeback, but instead, the smartest money in venture capital has found the exit ramp: the secondary VC transactions market. Data proves that with traditional M&A constrained and the public window shut, investors are making their own moves to […]

How Secondary Markets are Redefining Startup Liquidity in 2025

For years, the IPO has been the golden ticket. But in 2025, the tide has turned. Sophisticated secondary markets are intervening to give early employees, founders and investors the liquidity window they’ve been waiting for without relying on public markets that could take years to reopen. The private equity secondary market is becoming the pressure […]

Bridge Round Explained for Angel Investors Syndicates and Venture Funds

A bridge round used to be the private market’s quiet signal and a term often whispered only when a startup needed an extra six months of runway. But today, the capital landscape is more tactical and less linear, and this interim financing has transformed from a yellow flag to a valuable instrument for value creation. […]

Are VCs the New Investment Bankers Controlling Startup Liquidity?

Startup liquidity used to follow a predictable path. Raise capital, grow, and aim for an IPO or acquisition years down the road. But today’s market looks different. Exits are slower, private rounds stretch longer, and founders and early employees need liquidity long before an official exit, a shift that’s now fueling conversations about how VCs […]

What’s the Difference Between Venture Debt and Private Credit

Capital in private markets continues to evolve. Founders and investors now have more strategic ways to finance growth, and these two powerful financing options are gaining traction: venture debt and private credit. Both promise flexibility, faster access to funds, non-dilutive capital and less dependence on traditional banks, and yet they work very differently in practice. […]

Where’s the Liquidity? Secondaries, IPOs, and M&A are Reviving Private Markets in 2025

For years, converting paper gains into cash has been challenging for investors, who often wait for exits that rarely materialize. Liquidity in private markets remains scarce. In 2025, this picture is starting to change, with early green shoots emerging. From secondaries and continuation vehicles to standout IPOs and megadeals, innovative routes are springing open. Here’s […]

Why Automated SPV Platforms are Beating Investment Banks on Deal Close Time

In today’s private markets, speed matters for founders who want capital quickly and investors who wish to avoid wasting their time on bankers’ back-and-forth paperwork. Here’s where automated SPV platforms step in, changing the cycle of closing rounds from weeks to days. This article provides an insight into why automation is outperforming investment banks in […]

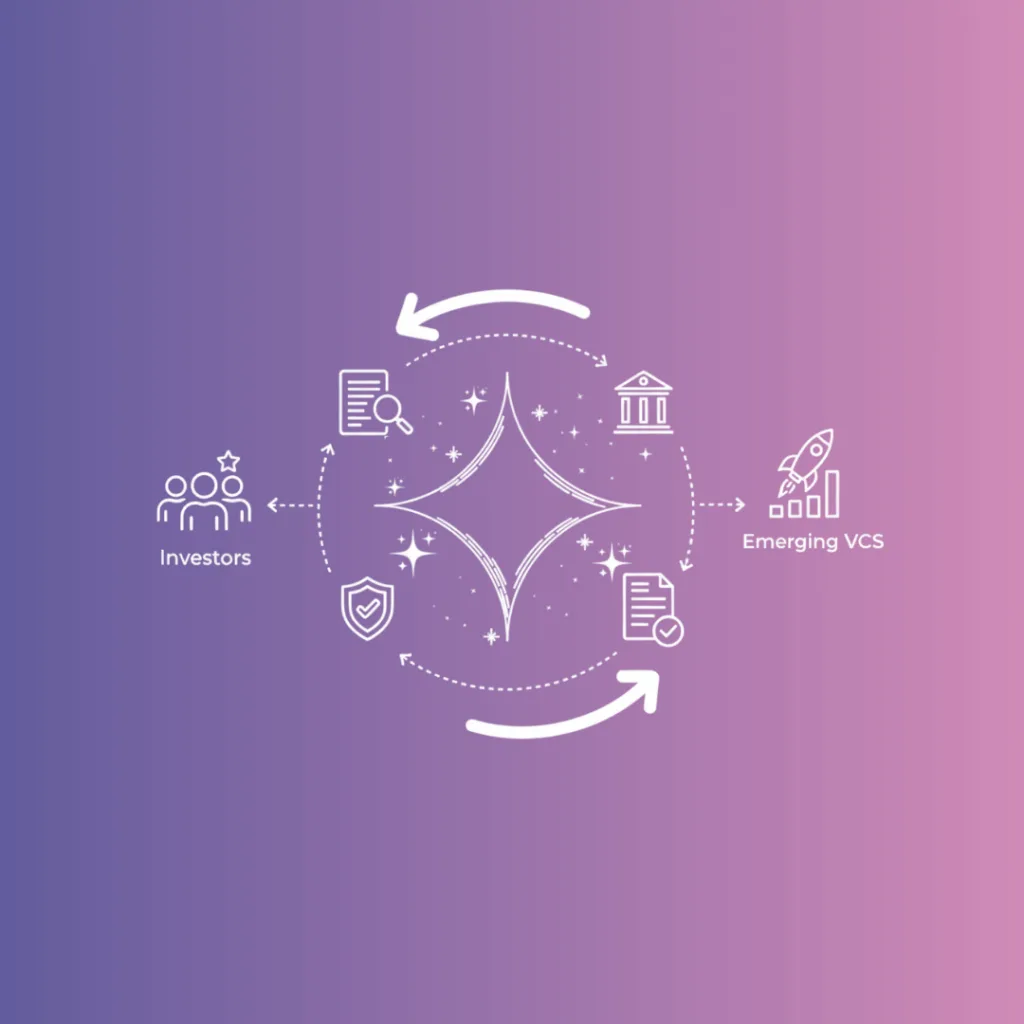

Nova Fund-in-a-Box Simplifies Fund Administration for Emerging VCs

Launching a fund can be exciting until the admin workload hits. Many emerging VCs begin by managing capital with spreadsheets, emails, and various service providers. That’s when reality strikes: Fund administration for emerging VCs isn’t just paperwork; it is the functional backbone that keeps investors confident and deals moving smoothly. Here, we’ll uncover why fund […]

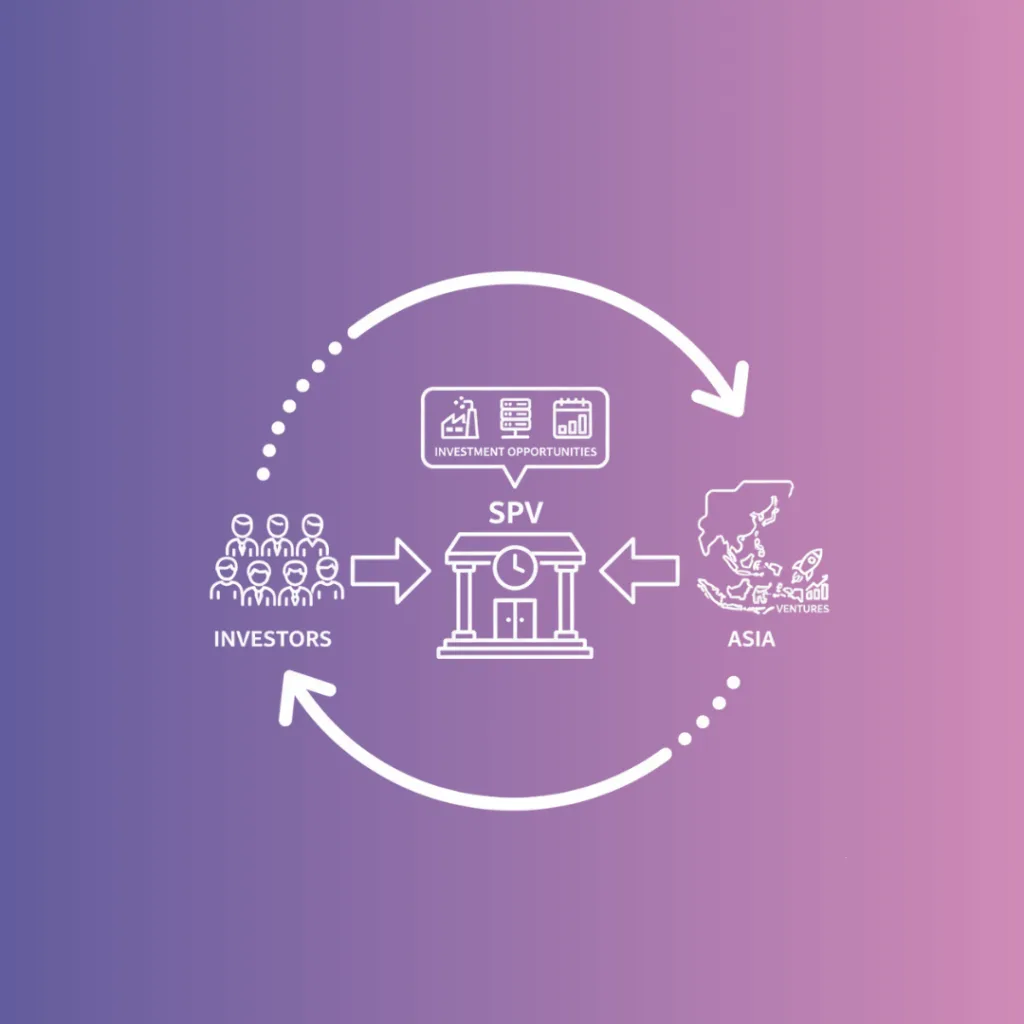

How to Launch a Syndicate in Asia Using an SPV?

For many investors launching a syndicate in Asia, it is crucial to have the right structure and execution right from the very beginning. That’s where a Special Purpose Vehicle (SPV) comes in, with its fast, compliant process for pooling capital, onboarding investors and moving on deals with efficiency and clarity. In this article, we’ll walk […]