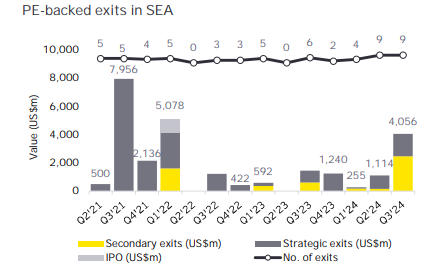

Southeast Asia’s investment landscape is poised for transformation, with secondary exits expected to gain momentum as a preferred liquidity strategy. Despite stabilizing Mergers and Acquisitions (M&A) volumes and subdued Initial Public Offering (IPO) activity in 2024, shifting funding dynamics and broader economic trends may also play a role. This article examines the key factors shaping the secondary market and the sectors that may drive growth in secondary exits in 2025.

Subdued IPO Activity

Public listings in Southeast Asia (SEA) slowed in 2024, with 122 IPOs raising approximately US$3.0 billion in the first ten months of the year. This lack of IPO activity has pushed investors to consider secondary exits as an effective way to realise returns, especially in key industries such as real estate, technology, and healthcare.

M&A Activity Outlook

M&A activity in Southeast Asia has stabilised, with deal volumes hovering at 40–50 annually, according to Tech in Asia. However, there has been a noticeable increase in median deal value, suggesting that while the number of deals has levelled off, the transactions are becoming larger and potentially more lucrative. This highlights a maturing investment market where higher-value deals pave the way for meaningful secondary exits.

Lower Borrowing Costs Boost Acquisitions

The US Federal Reserve’s recent interest rate cuts are expected to lower borrowing costs, making it easier for companies to finance acquisitions and enhancing deal valuations. This change could encourage more secondary transactions by creating favourable conditions for both buyers and sellers.

Industries Predicted to Drive Secondary Exits

Real Estate and Infrastructure

Real estate accounted for 40% of PE-backed investments in Q3 2024, driven by high-profile deals like Warburg Pincus’ US$1.2 billion acquisition of Singapore-based business parks. Stable occupancy rates and valuations make this sector particularly attractive for secondary transactions.

Digital infrastructure, with its stable cash flows and long-term contracts, continues to attract significant capital. These characteristics enable early investors to monetise their positions while ensuring project continuity.

Healthcare

Healthcare’s 18% share of PE deal value, bolstered by transactions like the Island Hospital deal in Malaysia, highlights its potential for secondary exits. The sector’s defensive nature and steady growth provide a stable option for investors looking for consistent returns.

Energy Transition

Renewable energy investments contributed 10% of PE activity, reflecting rising demand for sustainable infrastructure. Deals like Actis’s US$600 million investment in Terra Solar demonstrate the sector’s long-term growth potential. Maturing projects offer opportunities for early investors to execute secondary exits and recycle capital.

By leveraging growth in these industries, secondary exits serve as a reliable liquidity mechanism, allowing early investors to reinvest in emerging opportunities.

Emerging Sectors to Watch

While traditional PE sectors dominate current exit activity, these emerging industries are showing increasing potential for secondary transactions:

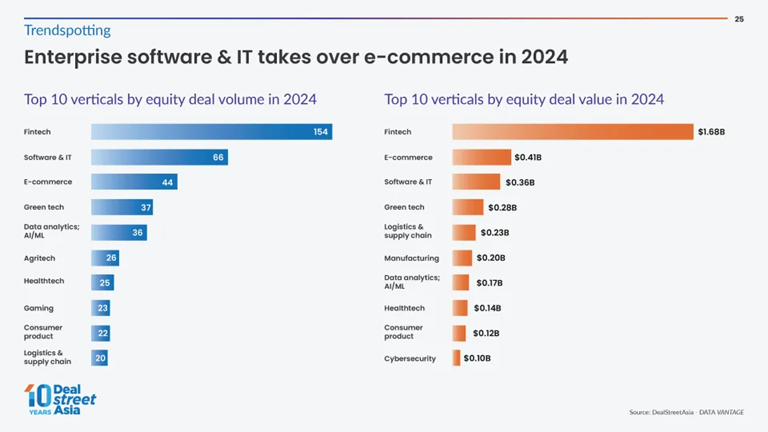

FinTech

Fintech led Southeast Asia’s funding landscape in 2024, raising US$821 million across 78 deals and accounting for 30% of total regional funding. As these companies mature and attract later-stage investors, secondary exits are becoming an effective mechanism for early backers to realise liquidity.

Gaming

Gaming experienced a 197% year-over-year growth in 2024, with standout deals like Zentry’s US$140 million funding round. This signals a maturing market, where secondary exits could offer early investors attractive opportunities to realise returns while maintaining company momentum.

Why Secondary Exits Matter

Secondary exits are becoming an essential mechanism for early investors to realise returns, especially as regional startups mature. Once viewed as a negative signal, these transactions are now seen as strategic opportunities for both investors and founders.

- Liquidity for Early Investors: Secondary exits allow early backers to cash out, enabling them to reallocate resources to new opportunities.

- Attracting Fresh Capital: By offering existing investors an exit, startups create room for new stakeholders, diversifying their investor base and ensuring sustained growth.

- Signaling Market Demand: Secondary transactions often reflect strong demand for the company’s shares, reassuring new investors of the startup’s potential.

Fandy Cendrajaya of Kopital Ventures aptly summarises this shift, “We hope to change the perception of secondary exits and make them the norm, as they signal strong demand for the company.”

The Impact of Secondary Exits on SEA

As SEA’s investment ecosystem matures, secondary exits are becoming an increasingly viable and accepted strategy for investors. These exits offer critical liquidity options in regions where IPOs remain relatively rare. By leveraging secondary exits, investors can navigate SEA’s fast-growing markets while aligning with proven businesses and emerging sectors.

Optimise Your Investment Journey with Us

Secondary exits provide a dynamic pathway for investors to unlock liquidity while supporting startups’ next growth stage. Whether you’re an early-stage investor or a founder, our platform equips you with the tools to navigate these opportunities effectively.

Streamline your investment operations with Auptimate’s intuitive platform. From Special Purpose Vehicle (SPV) creation to investor onboarding and payment tracking, we provide comprehensive tools that let you focus on strategic growth.

Book a call with our team today to explore how our SPV solutions can help with your investment goals or fundraising strategy.