Starting a business comes with a unique set of challenges. Every step requires focus, from building your product to acquiring your first customers and raising funding. For startup founders, understanding the role of an SPV can be essential, especially when managing your cap table, a critical but often underestimated task.

As a startup scales and attracts multiple investors, tracking equity ownership becomes increasingly complex. That’s where a Founder SPV, a Rollup Vehicle or a Cap Table Vehicle can help.

What is the Founder SPV?

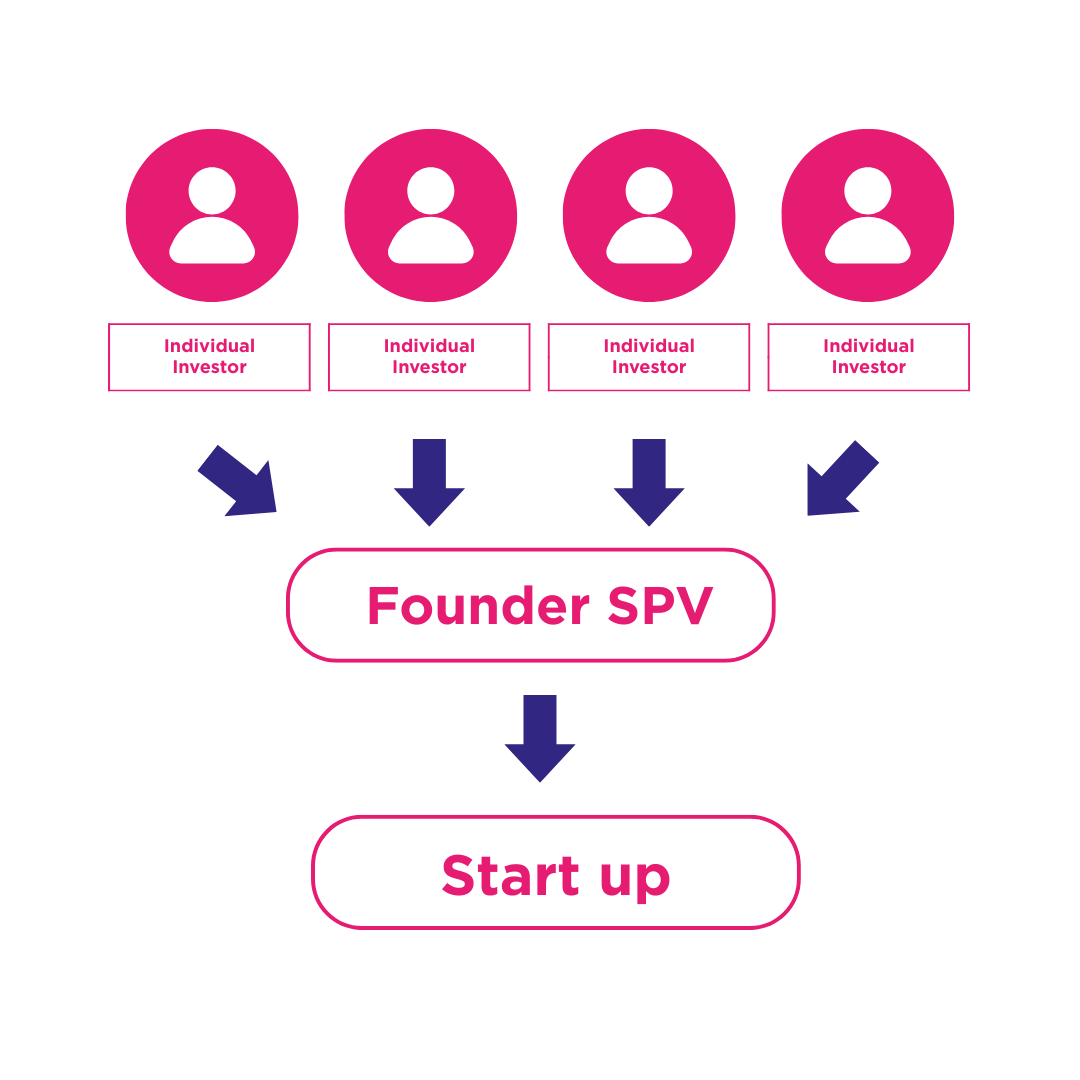

A Founder SPV (Special Purpose Vehicle) is a legal entity that holds equity in your startup on behalf of multiple investors. Instead of issuing shares directly to each investor, they invest through the SPV, which acts as a single shareholder on your cap table.

This structure simplifies ownership, streamlines decision-making, and makes your company more attractive to institutional and angel investors.

Not sure if a Founder SPV is right for you? Talk to our team for a quick walkthrough or get a sample structure tailored to your fundraising plans.

Benefits of Using a Founder SPV

1. Simplifies Cap Table Management

A cluttered cap table with dozens of individual investors can create friction during equity rounds, exits, and audits. A Founder SPV consolidates all investor shares into one entity, making your ownership structure cleaner and easier to manage.

2. Reduces Legal and Administrative Costs

Without an SPV, every investor needs a separate agreement, significantly raising legal costs. Using a Founder SPV means only one legal agreement and centralised communication, saving you time and money.

3. Improves Fundraising Efficiency

Many investors prefer investing through a single entity, particularly VCs and angels. A Founder SPV lowers their administrative burden, making your offering more appealing and helping you close funding rounds faster.

4. Provides Operational Flexibility

Selling shares, raising new rounds, or restructuring becomes easier when dealing with one legal entity instead of multiple individual shareholders. This flexibility is essential when scaling or pivoting your startup.

5. Helps Maintain Founder Control

A single-entity investor structure reduces complexity in governance. With fewer parties involved in key decisions, you retain more control over your company’s strategic direction.

6. Shareholder Limits

A Pte Ltd can accommodate up to 50 investors in countries like Singapore. A Founder SPV can be a handy tool to avoid breaching this limit and converting into a public company. By pooling multiple investors under a single vehicle, the SPV helps maintain the shareholder count within the allowable limit while simplifying ownership and management.

Potential Drawbacks to Consider

Founder SPVs offer many advantages, but are imperfect for every scenario. Some investors prefer direct ownership of shares and may hesitate to participate in an SPV. Others might be concerned about having limited influence over the company’s operations.

We recommend evaluating your investor pool and long-term strategic goals before deciding.

Is a Founder SPV Right for Your Startup?

If you’re raising funds, looking to simplify your cap table, or want to reduce legal complexity, a Founder SPV might be the right fit. It’s beneficial for founders planning multiple investor rounds or international fundraising campaigns.

Partner With Auptimate to Launch Your Founder SPV

Auptimate is the modern platform for setting up and operating investment vehicles, including Founder SPVs, syndicates, and venture funds.

We make it easy for founders and investors to:

- Incorporate your SPV quickly

- Onboard investors smoothly

- Administer your fund end-to-end

- Handle compliance, filings, and tax obligations globally

Conclusion

Founder SPVs are a smart, strategic way to manage investor participation and streamline your startup’s cap table as you scale. By consolidating multiple stakeholders into a single legal entity, you reduce complexity, lower legal costs, and maintain better control of your company’s equity structure.

Whether setting up your first SPV or scaling your investment network, our team at Auptimate is here to support you from start to finish. Book a call with us or get in touch with us at info@auptimate.com, and one of our experts will be more than happy to help.