This article was published on AngelSchool.vc and has been republished on Auptimate.com as part of an ongoing partnership.

Raising a fund as a first-time fund manager is a prolonged and time-consuming endeavor. Emerging fund managers also face higher risks compared to established funds.

We make the argument that Emerging Fund Managers should seriously consider a two-stage strategy: (i) start with their own syndicate to establish track record more quickly, then (ii) raising a formal fund with a validated thesis.

TLDR:

- Emerging Fund Managers face asymmetric risk: This arises from thesis-risk due to highly specific investment mandates and prolonged fundraising cycles. First-time funds are also smaller and often charge less carry.

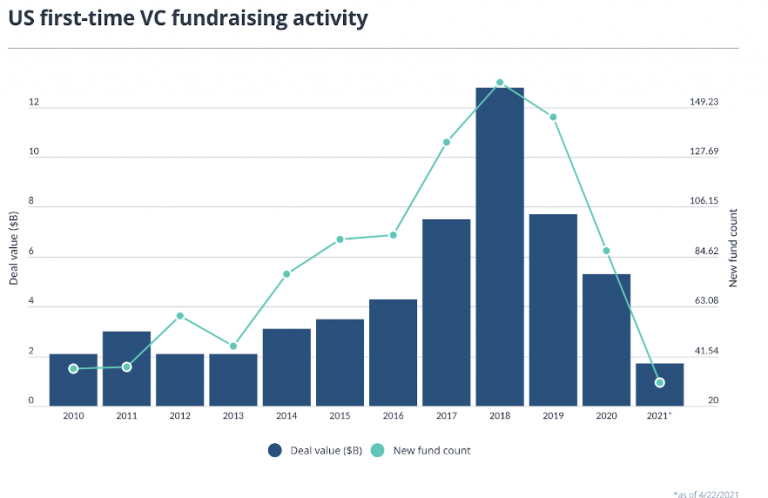

- Established funds are raising larger follow-on funds and doing it more quickly (as little as 12 – 18 months), soaking up capital. This makes it more challenging for first-time funds. The data clearly support this with 50% fewer first-time funds being established in 2020 compared to 2018.

- Syndicates are mathematically more profitable than VC funds due to the calculation of carried interest, even before factoring in return hurdles. This is an obvious benefit to using a syndicate model.

- Built with the right foundations, syndicates are a reliable source of capital that grows with the LP network. At minimum viable scale ($100k+), a syndicate can deploy comparable or higher levels of capital than a small first fund.

- Syndicates preserve optionality for Emerging Managers. Should the emerging manager progress to starting their own fund, they still have a syndicate network which allows them to double down on their fund positions.

Introduction

Raising a new fund as an emerging fund manager (i.e. first-time fund manager) is asymetrically difficult.

We make the 5 arguments that starting with a Syndicate offers a more efficient, less risky path to establishing one’s track record as a fund manager.

1. First time Funds are Exposed to More Risk Than Established Funds

1st time fund founders will almost universally tell you that it is extremely hard. Anecdotally, I know several investors personally (many have much deeper VC and PE backgrounds experience than I do) who will attest to this.

Many start out with micro-funds (<$10MN) and accept lower carry. They effectively subsidize the fund in order to close capital.

In order to differentiate, Emerging Managers tend to develop highly-focused and niche investment theses. Without a track record and thesis validation, and an established network of LPs, fundraising cycles are also prolonged This limits their investment scope, and creates sector-specific risk. Imagine raising a PropTech fund in the middle of WeWork tanking.

2. First Time Fundraising is Getting Harder!

According to Pitchbook data, the number of 1st time funds in the US almost halved from 162 to 87 between 2018 and 2020.

At the same time, venture funding hit nearly $80BN in 2020 and surpassed $100BN in 2021.

The story that this divergence in trends tells is that established funds are growing in size and raising new capital more quickly. Fundraising cycles have reduced from 3 – 4 years to 18 months (or less).

Concurrently, while venture assets have been on a bull run, their value on institutional LPs’ balance sheets have swelled. Institutional LPs like pension funds, endowments and foundations are unable to deploy more capital when this asset class exceed their allocation targets.

3. Syndicates are Mathematically More Profitable Than Funds

There are pros and cons to investing as a Syndicate Lead vs a VC fund. Notably, there is a certain prestige or allure to being ‘VC backed’ that offers VCs an advantage in deal access over syndicates. Syndicates also rely on LPs to make investment decisions on a deal-by-deal basis. This inevitably increases the investment cycle of a syndicate over a fund.

One of the lesser known but clear benefits of syndicates is that they are mathematically more profitable than funds. The reason is that VC funds calculate carried interest at the portfolio level whereas Syndicates calculate carry on a deal by deal basis; fund investments that produce a <1x return on capital produce a portfolio loss that affects the overall fund profitability. On the other hand, syndicates that return <1x capital result in 0 profit and carry for the syndicate lead. This is even before factoring the hurdle rate on fund carry.

Hence, assuming that a VC fund and Syndicate had an identical portfolio and identical positions in each company, the syndicate would produce a mathematically higher carried interest return for the syndicate lead.

4. Syndicates are a Scalable, Reliable Source of Capital

AngelSchool.vc has honed the craft of syndicate building by tackling it as a standalone subject matter or discipline.

We see time and again repeatable patterns at both LP/network and syndicate deal levels that drive virtuous loops. Notably, we see

- Consistent funnel metrics: Every syndicate generates predictable deal interest and commitment rates.

- Best-in-class Investor Engagement: Our automated emails get 60%+ open rates at top-of-funnel, 75%+ at mid-funnel

- Organic referrals: We’ve growth our LP network from 0 to 750+ completely organically through referrals.

This model enables an investor to build a Syndicate efficiently and reach minimum viable scale, which we define to be $100k+ capital deployment. This level of investment is comparable to, or exceeds that of small first funds and can be achieved more quickly than a full fundraising cycle.

As Syndicate leads execute more deals, a referral loop is activated wherein existing LPs introduce new investors to an active deal. This is powerful for 2 reasons: first, this grows your investor base and increases capital deployment capacity. Second, new LPs are immediately at mid-funnel. They are already actively engaged on a specific deal and are just 1 step away from an investment decision. This model has enabled me to grow my average cheque from to $500,000.

5. Syndicates Preserve Optionality

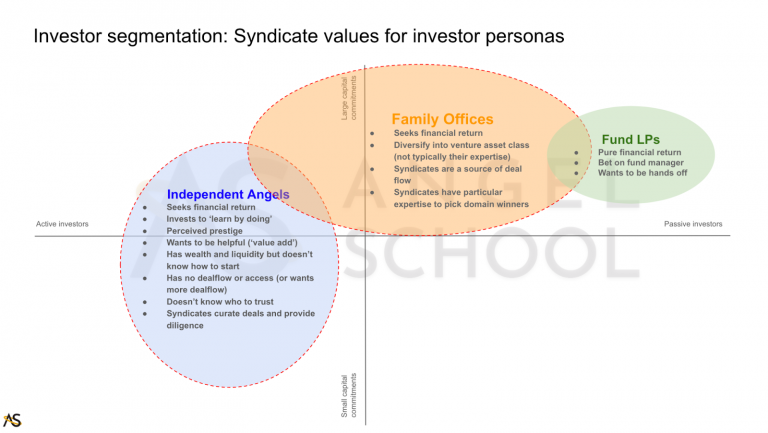

Syndicate and Fund LPs as largely different personas; they differ by their average cheque size and how active they prefer to be in the investment process.

Syndicate leads can use the syndicate model to build track record and prove their investment thesis more quickly. They can then raise a fund using these proofpoints in a more efficient manner.

Since Fund and Syndicate LP personas largely do not overlap, the Fund Manager would still have a syndicate network to double down on their investment positions.

In this light, syndicates preserve optionality for the Emerging Manager to progress from a syndicate to fund. When their fund is set up, having a syndicate LP network allows them to increase their investment positions to capture more carry and upside.

Conclusion

Based on these arguments, we advocate for Emerging Fund Managers to consider a two-stage strategy: (i) start with their own syndicate to establish track record, then (ii) raising a formal fund with a validated thesis while being able to double down on fund positions using their syndicate.

About Angel School

AngelSchool.vc is a Fellowship program dedicated to helping Angel Investors build their own syndicates. We equip Program Fellows with a syndicate blueprint in just 8 weeks. After that, they’re invited to our Investment Committee (IC) to gain real deal experience and earn carried interest. Apply to our next cohort.

Angel School’s syndicate is backed by 1000+ LPs and deploys $MNs annually. Subscribe here for access to our exclusive dealflow.