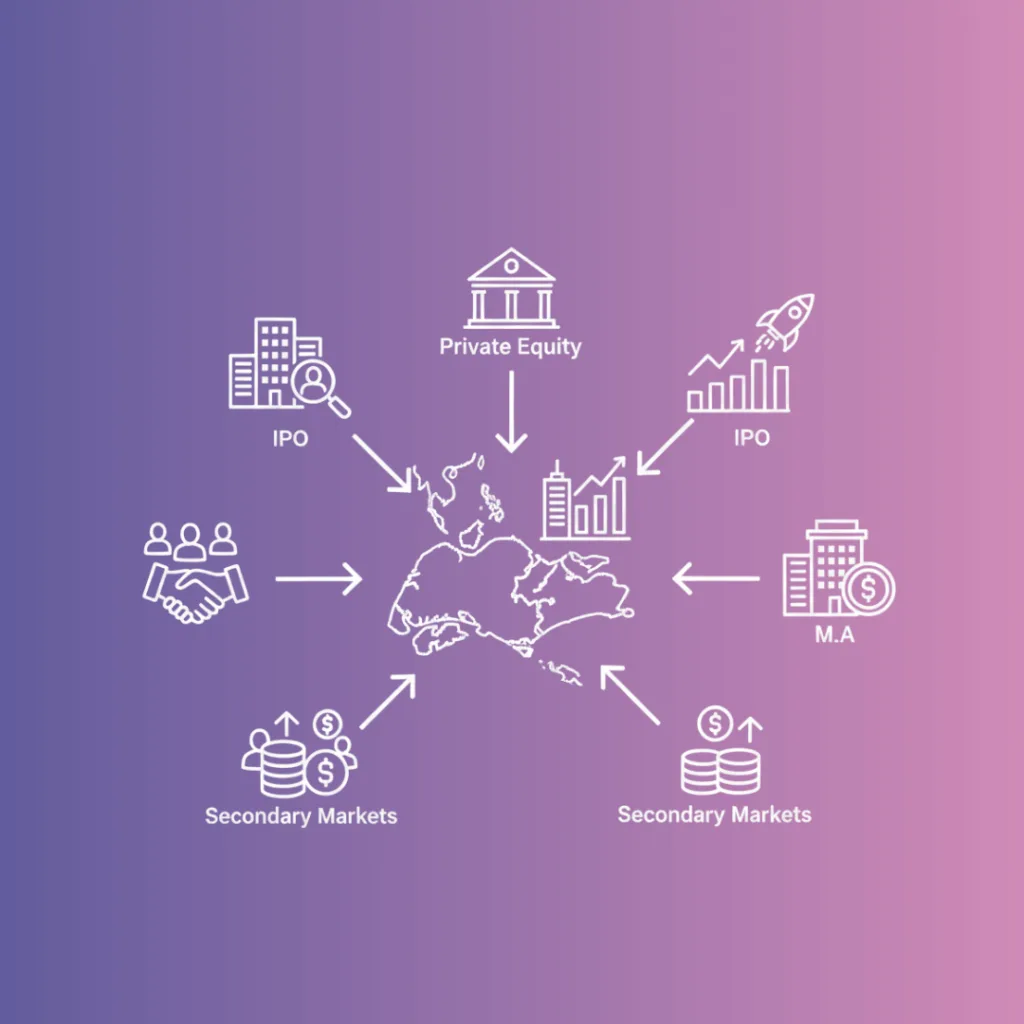

How Singapore’s Private Equity Activity is Reshaping Exit Pathways for Startups

For founders and investors in Singapore, the traditional exit routes—that dream IPO listing or a neat M&A sale to a corporate giant—have all but dried up. The Southeast Asia IPO market just hit its lowest capital raised in nine years, and M&A volume has been stuck in neutral for two straight years. The liquidity pressure […]

How Angel Investors Use SPVs to Access Private Credit and Secondaries

Private markets are evolving fast, and angel investors no longer have to sit on the sidelines. With an SPV (special purpose vehicle) in private credit and secondaries, investors can access strategies once limited to institutions, such as direct lending and late-stage equity. In this guide, we’ll break down how SPVs open doors to private credit, […]

Unlocking Liquidity: How Secondaries Benefit VCs and Early Investors in Venture Capital

In the world of venture capital, where long-term investments and illiquidity are common, secondaries have emerged as a valuable tool. These transactions provide liquidity options for venture capital firms (VCs) and early investors, allowing them to manage their portfolios effectively and generate returns before the occurrence of a significant exit event like an IPO or […]