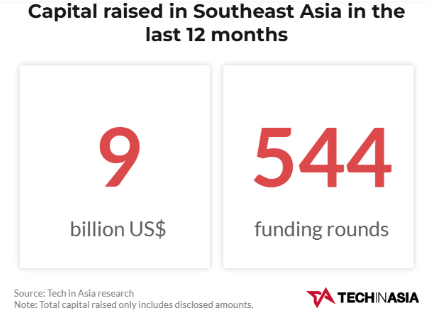

Southeast Asia’s startup ecosystem has demonstrated resilience and adaptability, attracting significant investment over the past year. Despite global economic uncertainty, the region raised $9 billion across 544 funding rounds in the last 12 months, underscoring its growing appeal to investors.

SEA Funding: A Year in Numbers

In the past 12 months, Southeast Asia raised $9 billion in disclosed capital. The number of funding rounds shows a steady momentum, reflecting the increasing investor confidence in the region. Singapore and Indonesia led the pack in funding amounts and deal counts, collectively contributing the lion’s share of investments. Meanwhile, countries like Vietnam and the Philippines are emerging as notable contenders.

Industries Driving Growth

E-commerce continues to dominate Southeast Asia’s funding landscape, accounting for $4.1 billion of the total raised. Other significant contributors include Financial Technology (Fintech), Cleantech, and Gaming. While Fintech remains a magnet for early-stage investments, Cleantech is gaining ground as sustainability becomes a regional priority.

Among the notable Cleantech investments, Cyan Renewables raised $50 million in bridge financing, highlighting the sector’s growth potential. Similarly, HealthifyMe secured $20 million, reflecting investor interest in Healthtech and wellness solutions.

Companies Leading the Way

Several companies stand out for their large funding rounds. DigitalLand Holdings raised $1 billion in a Series B round, marking one of the largest deals in the region this year. ADVANCE.AI and Finfra attracted significant seed-stage investments in Fintech, showcasing the sector’s robustness.

Another notable trend is the rise of regional startups expanding into underserved markets. Chickin, an Agritech company, raised $15 million in Series A funding to revolutionise poultry farming, underscoring investor interest in innovative solutions for traditional industries.

Macro Trends

Investors increasingly focus on sectors aligned with regional needs, such as clean energy and logistics. The funding landscape also highlights the growing involvement of institutional investors, with firms like The Radical Fund and EQT making notable contributions across multiple verticals.

Funding stages reveal a healthy mix of early and growth-stage investments. While seed-stage funding remains dominant, accounting for 126 rounds, Series A and bridge rounds also saw robust activity, indicating startups’ ability to scale despite economic headwinds.

SEA: A Hotbed for Investment Opportunities

The SEA funding landscape shows strong signs of recovery and growth, with consistent quarterly gains and thriving industries like FinTech, E-commerce, and Gaming. With $9 billion in capital raised, the region cements its status as an attractive destination for global investors.

Investing through a Special Purpose Vehicle (SPV) offers a seamless way to access these lucrative opportunities in SEA while ensuring efficiency and compliance. At Auptimate, we simplify the SPV process—from formation and investor onboarding to ongoing management and reporting. Whether you’re an angel syndicate or a fund manager, our platform empowers you to focus on strategic investments while we manage the complexities.

Book a call with our experts today to explore tailored SPV solutions for your investment needs.