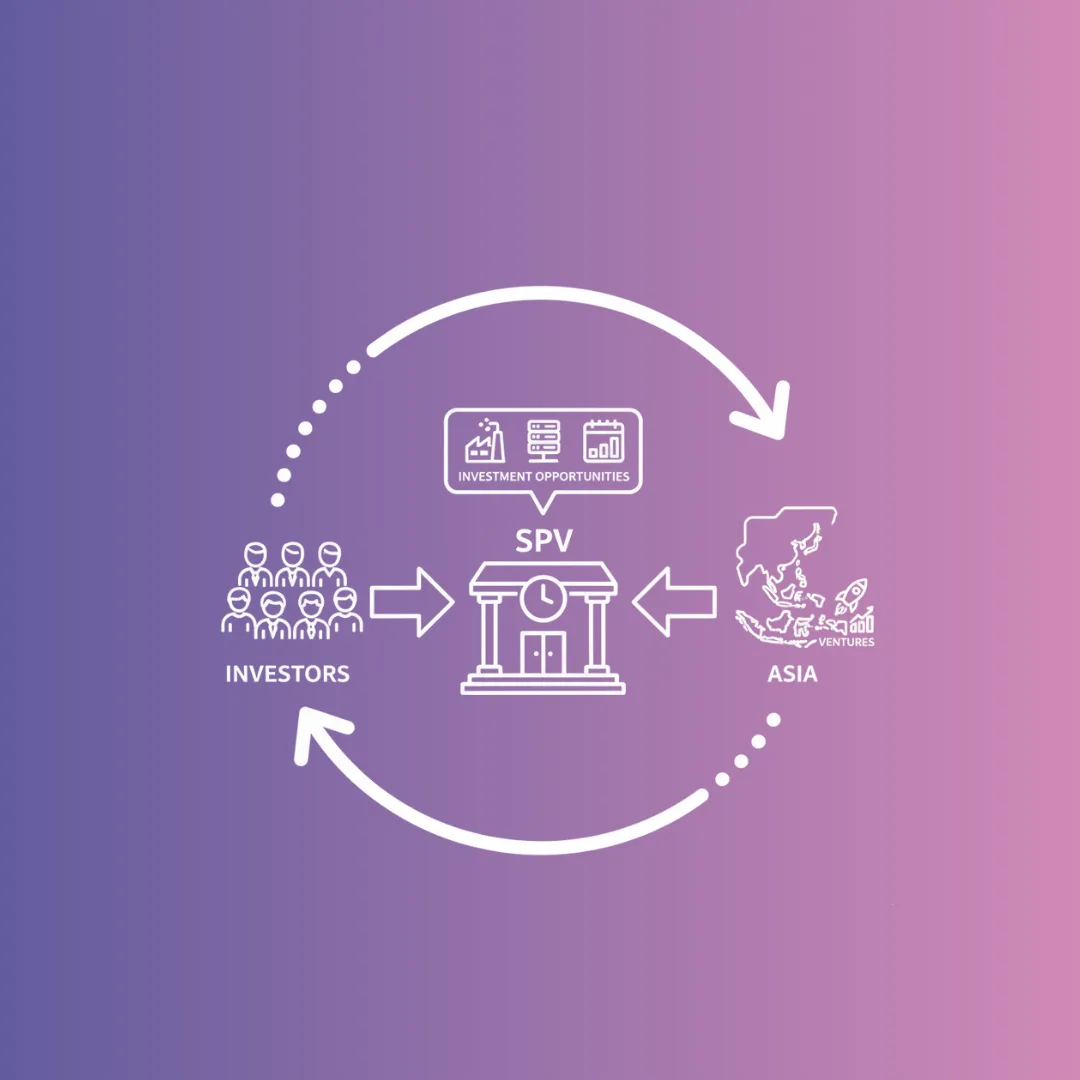

For many investors launching a syndicate in Asia, it is crucial to have the right structure and execution right from the very beginning. That’s where a Special Purpose Vehicle (SPV) comes in, with its fast, compliant process for pooling capital, onboarding investors and moving on deals with efficiency and clarity.

In this article, we’ll walk you through the operational steps to launch an SPV-backed syndicate in Asia, from choosing your jurisdiction to handling compliance and wrapping up after exit, so you can set up a syndicate that limited partners and founders would trust.

Why Use an SPV to Launch a Syndicate in Asia

An SPV (special purpose vehicle) simplifies a syndicate by consolidating many investors into one legal entity that signs with the target company. It protects individual investors from direct liability, speeds negotiations by keeping a single counterparty on the cap table, and can deliver tax and withholding advantages depending on your domicile.

Singapore remains popular because it generally does not tax capital gains and offers robust treaty coverage—practical perks for cross-border exits.

As PwC notes, “To increase tax efficiency, some operators use structures called conduits in which they have SPEs own power-generating equipment so that the operator does not bear tax liability.”

In short, the proper SPV framework turns your syndicate from a one-off project into a repeatable, scalable investment engine.

Steps to Launch an SPV-Backed Syndicate in Asia

Setting up a syndicate in Asia using an SPV may seem complex, but it follows a structured, straightforward process. Here are the key steps to launch and manage your SPV-backed syndicate smoothly.

- Pick the right jurisdiction

Start by asking: where will most investors sit, where will tax treaties matter, and how fast do you need the SPV set up? Singapore offers low tax friction, strong infrastructure, and an extensive service ecosystem. Hong Kong provides proximity to Greater China markets and a flexible regulatory environment. Cayman or Delaware can offer speed and familiarity with investors.

Choose the domicile that aligns with your investor geography, target company location, and exit strategy.

- Structure the SPV like a pro

Once you pick a jurisdiction, structure your entity as a Pte. Ltd, VCC, LLC or LP and draft the foundational docs. That includes the Operating or Limited Partnership Agreement (defines GP/lead and LPs’ duties and economics), subscription agreements, and the cap-table mechanics for the SPV.

Prepare core documents such as:

- The Operating or Limited Partnership Agreement (defines roles, fees, and carry)

- Subscription agreements (outline investor participation)

- Shareholders’ Agreement (sets decision-making rights and exit rules)

Clarity here avoids headaches later: what happens if you rollover into a follow-on, how does profit carry work, who votes on follow-ons?

- Onboard investors and stay compliant

Investor onboarding is your first impression. Use digital platforms like Auptimate to run KYC (Know Your Client) and AML (Anti-Money Laundering) checks, accredited investor checks and e-sign subscription documents, and document storage so capital calls and distributions run smoothly.

Automating these steps speeds up the SPV for syndicate launch process and removes friction for investors. A clean onboarding flow improves investor satisfaction and allows you to close deals faster.

Ready to streamline investor onboarding? Schedule a call with our expert to see how we can help automate KYC and subscription

- Manage capital, closings, and operations

In a typical one-deal SPV, you’ll raise commitments, then at closing you call capital. Set an escrow account, define subscription deadline, and coordinate closing logistics. Pool the funds, deploy into the target startup, and manage the process with precision. Efficient closing accelerates your time-to-invest and maximises syndicate momentum.

- Administer ongoing operations and compliance

Post-investment, you must maintain accurate books, provide transparent reporting, file local tax returns and run the waterfall distribution mechanics. Automating fund-administration tasks keeps everything clean and audit-ready. For a syndicate lead committed to scale, operational excellence is a true competitive advantage.

- Plan your exit and wind-up early

Exit mechanics matter. From the moment you invest, you should define how proceeds flow, the distribution waterfall, tax implications across jurisdictions and how you dissolve the SPV cleanly. Poor exit planning delays returns for investors and weakens your track record. A tightly planned wind-down positions you well for your next SPV for syndicate launch.

Legal and compliance checklist for syndicate leads

Running a syndicate through an SPV requires meeting the standards of your chosen jurisdiction. In Singapore, that means alignment with the Monetary Authority of Singapore (MAS) and Accounting and Corporate Regulatory Authority (ACRA) frameworks.

Here are the core legal and compliance elements every syndicate lead should prepare:

- Entity setup documents – Incorporation filings, constitution, and corporate secretary appointments

- Syndicate or management agreement – Defines responsibilities, carried interest, and governance

- Subscription package – Includes investor declarations, AML/KYC, and commitment details

- Shareholders’ agreement – Sets decision-making, transfer rights, and exit provisions

- Regulatory filings – Annual returns, tax filings, and (if required) investor accreditation reports

- Investment documentation – Term sheet and share subscription agreement with the target company

Get these right once, and you’ll be able to replicate future SPVs efficiently across deals and investors.

Final Thoughts

Setting up an SPV for syndicate launch gives syndicate leads a practical, founder-friendly way to pool capital and move fast if you pick the right domicile, use clean governance, automate onboarding, and plan exits tightly. Keep operations lean by outsourcing administration and standardizing investor reporting. Do that, and you’ll run repeatable deals with minimal friction.

Looking for a fast, compliant Singapore SPV that gets deals done? Book a call with us or get in touch with us at info@auptimate.com, and one of our experts will be more than happy to help.