The First Decisions of the Year: How Angels Are Allocating Capital in Q1

Angel investing does not start fresh every January. It carries the weight of prior cycles, past outcomes, and hard-earned lessons. The first decisions of the year tend to be deliberate, shaped less by optimism and more by experience. In Q1, angels across Asia and globally are approaching capital allocation with clearer intent. To understand what […]

How Convertible Notes Work with SPVs in Early-Stage Angel Rounds

Convertible notes are the fast lane for early-stage angel investment, letting investors back startups without getting bogged down in valuations or complex equity terms. When routed through SPVs, they bring added efficiency, pooled capital, and strategic flexibility. Pooling capital via SPVs, navigating conversion timing, discounts, and valuation caps are just a few of the nuances […]

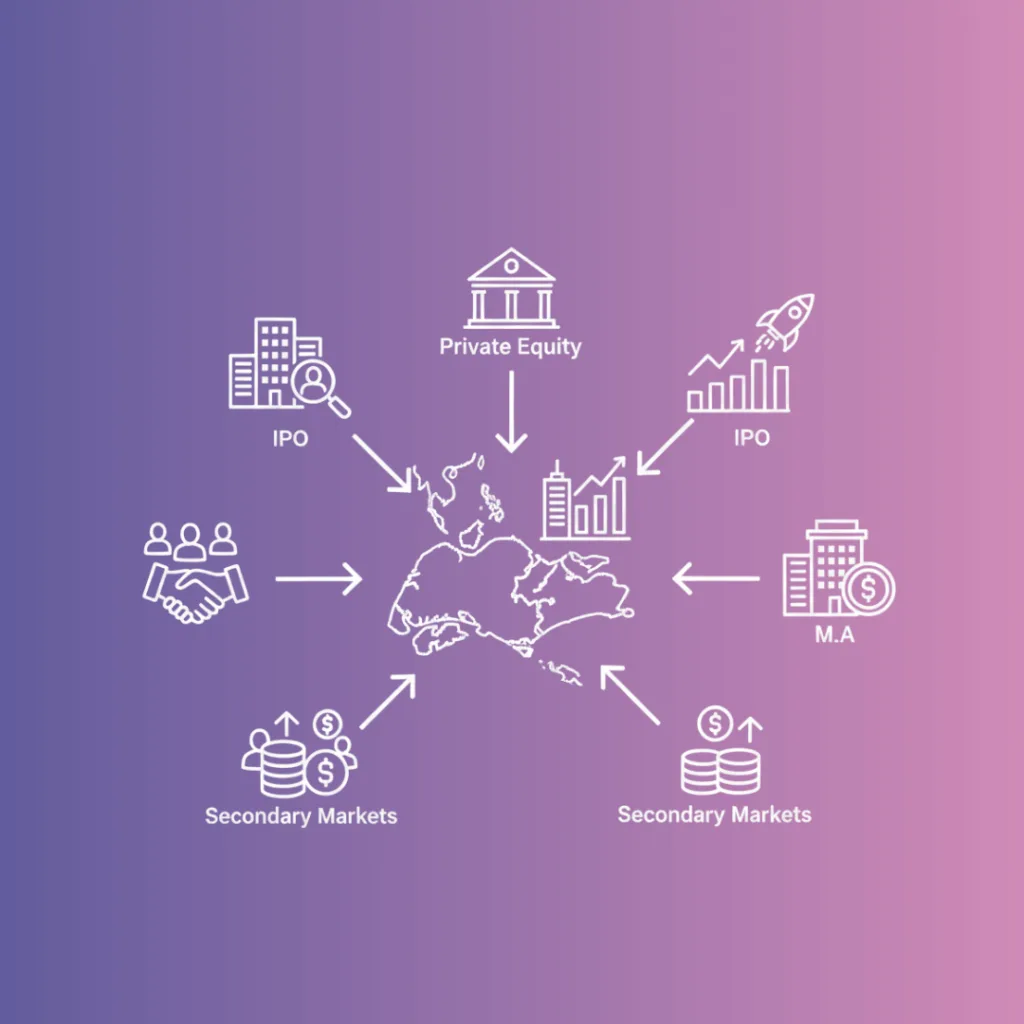

How Singapore’s Private Equity Activity is Reshaping Exit Pathways for Startups

For founders and investors in Singapore, the traditional exit routes—that dream IPO listing or a neat M&A sale to a corporate giant—have all but dried up. The Southeast Asia IPO market just hit its lowest capital raised in nine years, and M&A volume has been stuck in neutral for two straight years. The liquidity pressure […]

How Secondary Markets are Redefining Startup Liquidity in 2025

For years, the IPO has been the golden ticket. But in 2025, the tide has turned. Sophisticated secondary markets are intervening to give early employees, founders and investors the liquidity window they’ve been waiting for without relying on public markets that could take years to reopen. The private equity secondary market is becoming the pressure […]

Bridge Round Explained for Angel Investors Syndicates and Venture Funds

A bridge round used to be the private market’s quiet signal and a term often whispered only when a startup needed an extra six months of runway. But today, the capital landscape is more tactical and less linear, and this interim financing has transformed from a yellow flag to a valuable instrument for value creation. […]

What’s the Difference Between Venture Debt and Private Credit

Capital in private markets continues to evolve. Founders and investors now have more strategic ways to finance growth, and these two powerful financing options are gaining traction: venture debt and private credit. Both promise flexibility, faster access to funds, non-dilutive capital and less dependence on traditional banks, and yet they work very differently in practice. […]

Where’s the Liquidity? Secondaries, IPOs, and M&A are Reviving Private Markets in 2025

For years, converting paper gains into cash has been challenging for investors, who often wait for exits that rarely materialize. Liquidity in private markets remains scarce. In 2025, this picture is starting to change, with early green shoots emerging. From secondaries and continuation vehicles to standout IPOs and megadeals, innovative routes are springing open. Here’s […]

Why Automated SPV Platforms are Beating Investment Banks on Deal Close Time

In today’s private markets, speed matters for founders who want capital quickly and investors who wish to avoid wasting their time on bankers’ back-and-forth paperwork. Here’s where automated SPV platforms step in, changing the cycle of closing rounds from weeks to days. This article provides an insight into why automation is outperforming investment banks in […]

Syndicate SPV: The Ultimate Tool for Angel Investors and Syndicate Leads

Angel investors know the best deals move fast, and the structure you use can make or break the experience. A Syndicate SPV (special purpose vehicle) simplifies startup investing by consolidating multiple investors into a single, streamlined entity, providing founders with a single cap table entry while reducing the administrative burden for all parties involved. For […]

How Much Do You Need to Invest in a Syndicate SPV?

For many angel investors, the first question before backing a deal isn’t about valuation or upside. It’s about how much capital you need to put in. The minimum investment in syndicate SPVs (Special Purpose Vehicles) can shape who gets access, how founders raise, and how diverse the cap table becomes. This guide breaks down everything […]