The First Decisions of the Year: How Angels Are Allocating Capital in Q1

Angel investing does not start fresh every January. It carries the weight of prior cycles, past outcomes, and hard-earned lessons. The first decisions of the year tend to be deliberate, shaped less by optimism and more by experience. In Q1, angels across Asia and globally are approaching capital allocation with clearer intent. To understand what […]

What LPs Actually Look for Before Committing to a First-Time Fund Manager

For first-time fund managers, raising capital is rarely about vision alone. Limited Partners approach emerging managers with a structured and risk-aware mindset. They assess decision quality, operational discipline, and the ability to manage capital across the full fund lifecycle. These expectations are especially pronounced in established fund centers such as Singapore and the United Arab […]

From Syndicate to Fund: When It Makes Sense to Level Up Your Structure

A common question among repeat syndicate leads Many syndicate leads start with a simple question: “Should I just keep running SPVs, or is it time to launch a fund?” There is no universal threshold where a syndicate suddenly becomes a fund. Instead, the transition usually happens when operational complexity, investor expectations, and capital cadence begin […]

Small vs Large Funds: The 2025 Fundraising Split That Shapes 2026

Across private markets, LPs became more selective, liquidity remained uneven, and re-ups increasingly flowed to managers with proven systems. The result was a clear split: larger funds and established platforms continued to close, while smaller vehicles faced a tougher bar and longer timelines. This matters for 2026 because it changes the real question from “Is […]

The Flight to Quality: Steering Through the 2025 Private Market Reset

The transition into 2026 represents one of the most significant structural shifts in the history of private capital. Global private markets are no longer operating under the speculative fervor of the early 2020s. Instead, they have entered a period of sober recalibration where capital is concentrated in the hands of the most proven operators. For […]

How to Communicate With LPs Throughout the Lifetime of an SPV

Keeping investors in the loop builds trust, confidence and long-term relationships. LP reporting transforms what seems like administrative overhead into an efficient way to show transparency, track progress and highlight the impact of every SPV investment. Capital calls, quarterly updates, post-exit summaries, and performance dashboards show how SPVs move through distinct stages where transparent LP […]

How Convertible Notes Work with SPVs in Early-Stage Angel Rounds

Convertible notes are the fast lane for early-stage angel investment, letting investors back startups without getting bogged down in valuations or complex equity terms. When routed through SPVs, they bring added efficiency, pooled capital, and strategic flexibility. Pooling capital via SPVs, navigating conversion timing, discounts, and valuation caps are just a few of the nuances […]

How Strategic M&A Shapes Modern Family Office Investment Strategy

What began as a directive to preserve wealth has transformed into a far more family office investment strategy, where family offices are no longer satisfied playing defense. They are now shaped by selective deal-making, professional teams and more focus on returns that actually move the needle. Recent data show that most family offices today were […]

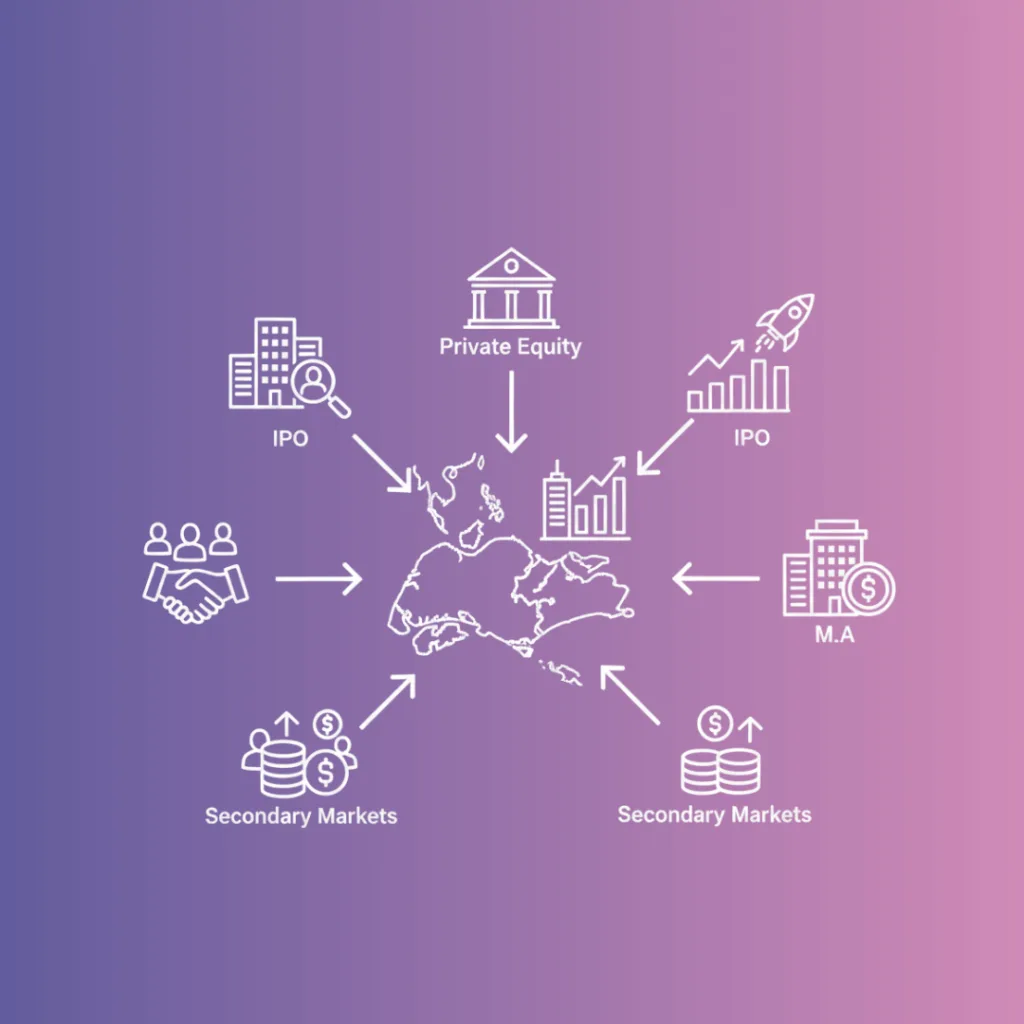

How Singapore’s Private Equity Activity is Reshaping Exit Pathways for Startups

For founders and investors in Singapore, the traditional exit routes—that dream IPO listing or a neat M&A sale to a corporate giant—have all but dried up. The Southeast Asia IPO market just hit its lowest capital raised in nine years, and M&A volume has been stuck in neutral for two straight years. The liquidity pressure […]

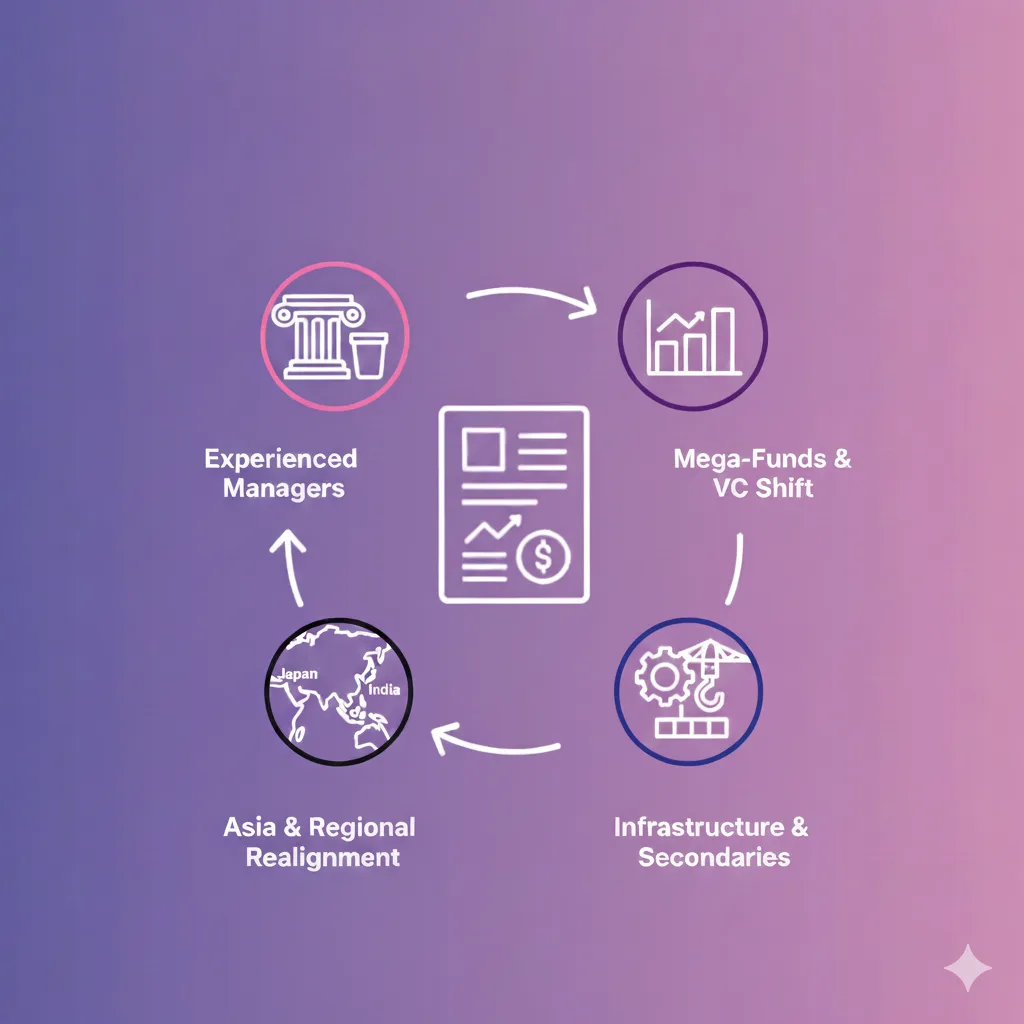

Where Asian Private Markets are Headed this 2026

Asia’s private markets trend for 2026 is shaping up to be both a rebound and a redesign. Liquidity is expanding, but it no longer flows only through IPO lanes but instead, private credit, secondaries and hybrid fund structures now shape outcomes. GPs, family offices and allocators who move fast on structure, liquidity engineering and cross-border […]