Where’s the Liquidity? Secondaries, IPOs, and M&A are Reviving Private Markets in 2025

For years, converting paper gains into cash has been challenging for investors, who often wait for exits that rarely materialize. Liquidity in private markets remains scarce. In 2025, this picture is starting to change, with early green shoots emerging. From secondaries and continuation vehicles to standout IPOs and megadeals, innovative routes are springing open. Here’s […]

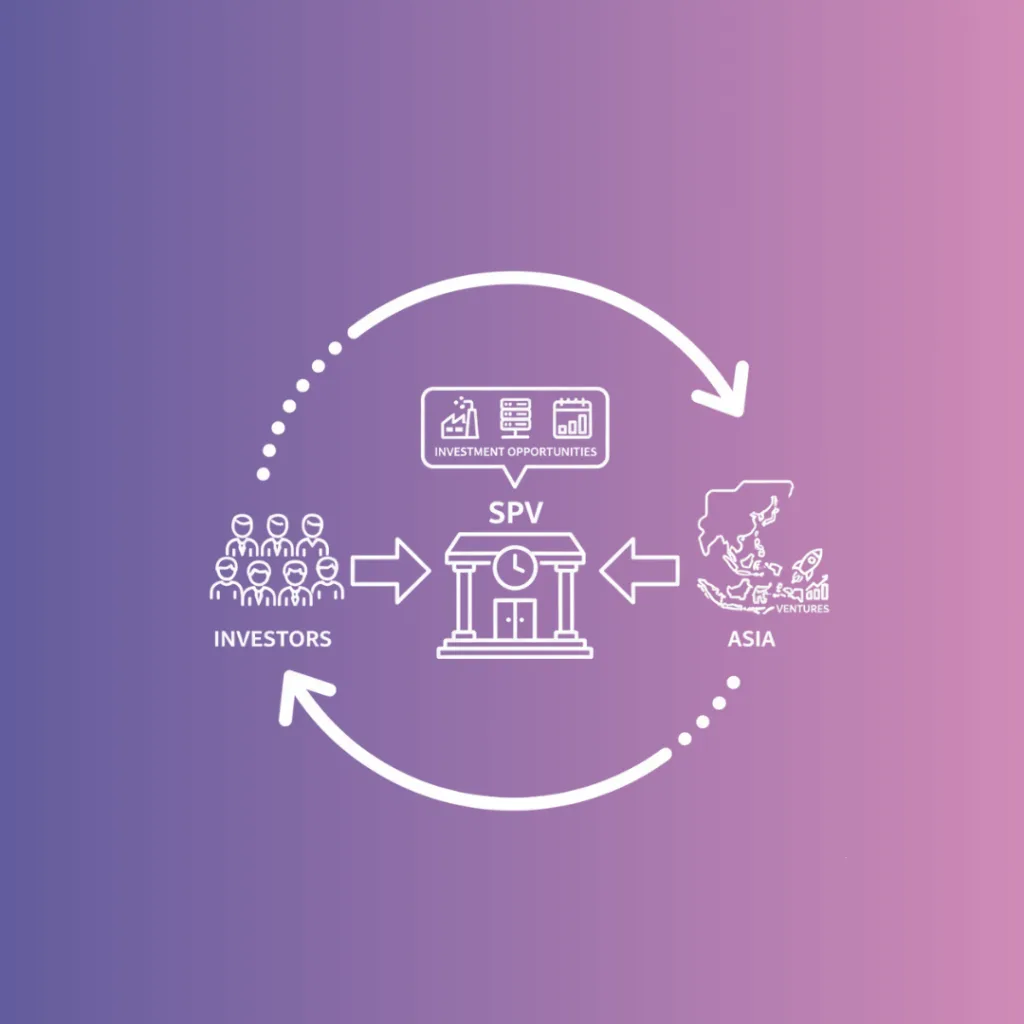

How to Launch a Syndicate in Asia Using an SPV?

For many investors launching a syndicate in Asia, it is crucial to have the right structure and execution right from the very beginning. That’s where a Special Purpose Vehicle (SPV) comes in, with its fast, compliant process for pooling capital, onboarding investors and moving on deals with efficiency and clarity. In this article, we’ll walk […]

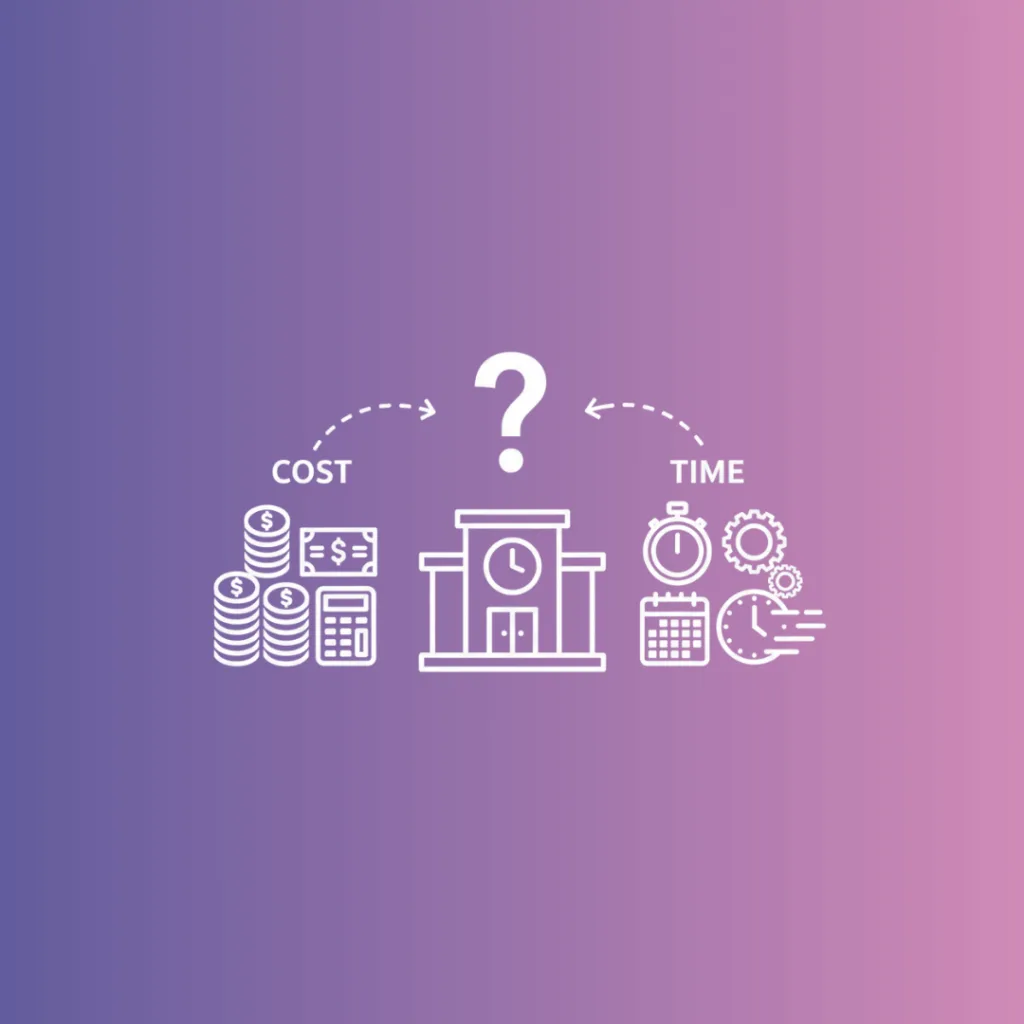

How Much to Launch an SPV in Singapore and How Long It Takes

Launching a deal shouldn’t feel like starting a fund. Many investors now use SPVs, a faster and more flexible way to pool capital for a single opportunity. In Singapore, SPVs have become the go-to structure for cross-border syndicates and emerging fund managers seeking speed without incurring heavy setup costs or complexity. Still, one question always […]

How Global Investors Access Singapore SPVs: The Complete Guide

Singapore is fast becoming the launchpad for global investors looking to tap into Asia’s thriving startup scene. Syndicate leads and angels abroad may often ask: Can non-Singaporean investors participate in Singapore SPVs? The answer is yes, and the process is more straightforward than many think. This article explains how SPVs for non-Singapore investors work, key […]

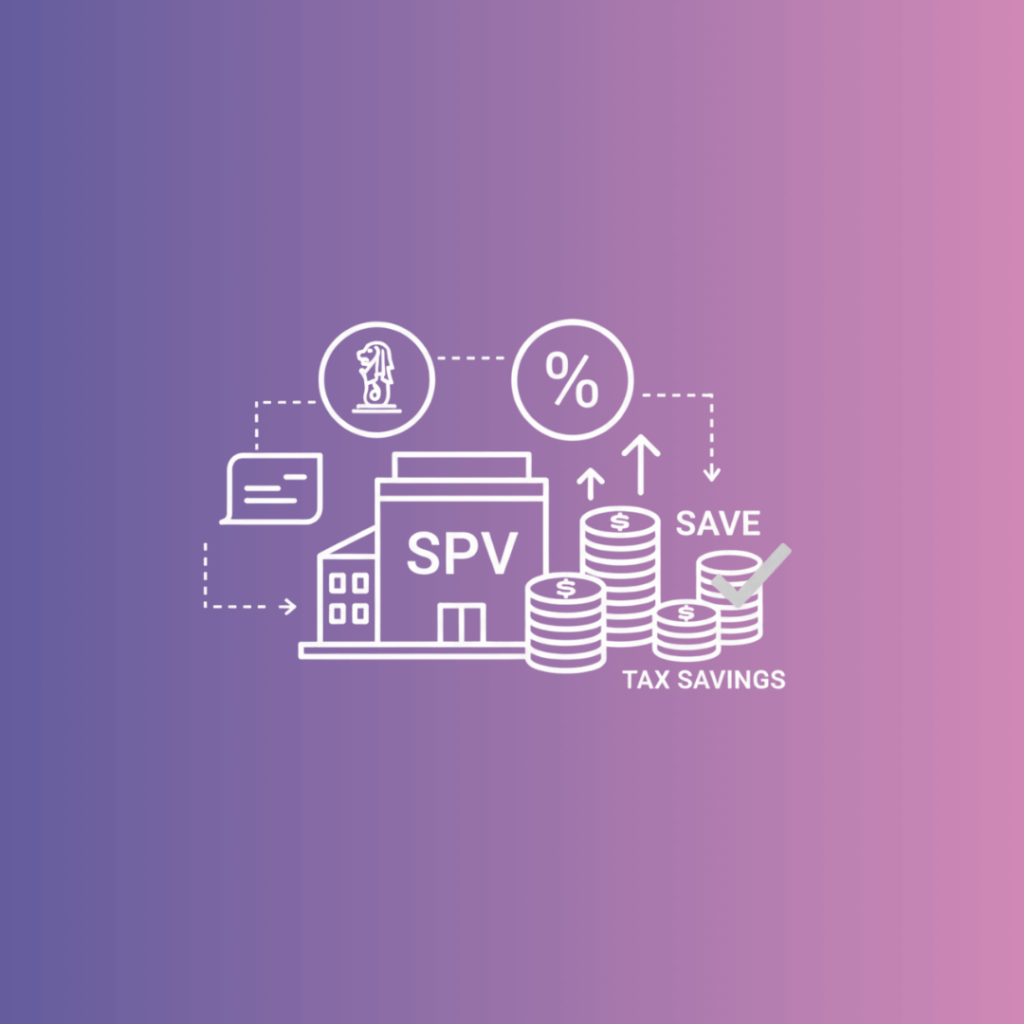

Is a Singapore SPV Tax-Efficient for Global Investors? The Full Analysis

Singapore has become one of the most attractive jurisdictions for structuring investments, primarily through the use of Special Purpose Vehicles (SPVs). For global investors, the draw goes beyond reputation. The real value lies in Singapore SPV’s tax efficiency. In this article, we examine how Singapore SPVs offer tax efficiency for global investors, highlighting their advantages, […]

What is a Debt SPV and How Does it Work?

A startup needs a quick bridge round. Instead of setting up a full-fledged fund, investors pool their capital into a lean, purpose-built vehicle that issues short-term loans. The deal gets done fast, risks stay contained, and everyone knows exactly where they stand. That’s the power of a Debt SPV. In this article, we’ll unpack what […]

Syndicate SPV: The Ultimate Tool for Angel Investors and Syndicate Leads

Angel investors know the best deals move fast, and the structure you use can make or break the experience. A Syndicate SPV (special purpose vehicle) simplifies startup investing by consolidating multiple investors into a single, streamlined entity, providing founders with a single cap table entry while reducing the administrative burden for all parties involved. For […]

How Angel Investors Use SPVs to Access Private Credit and Secondaries

Private markets are evolving fast, and angel investors no longer have to sit on the sidelines. With an SPV (special purpose vehicle) in private credit and secondaries, investors can access strategies once limited to institutions, such as direct lending and late-stage equity. In this guide, we’ll break down how SPVs open doors to private credit, […]

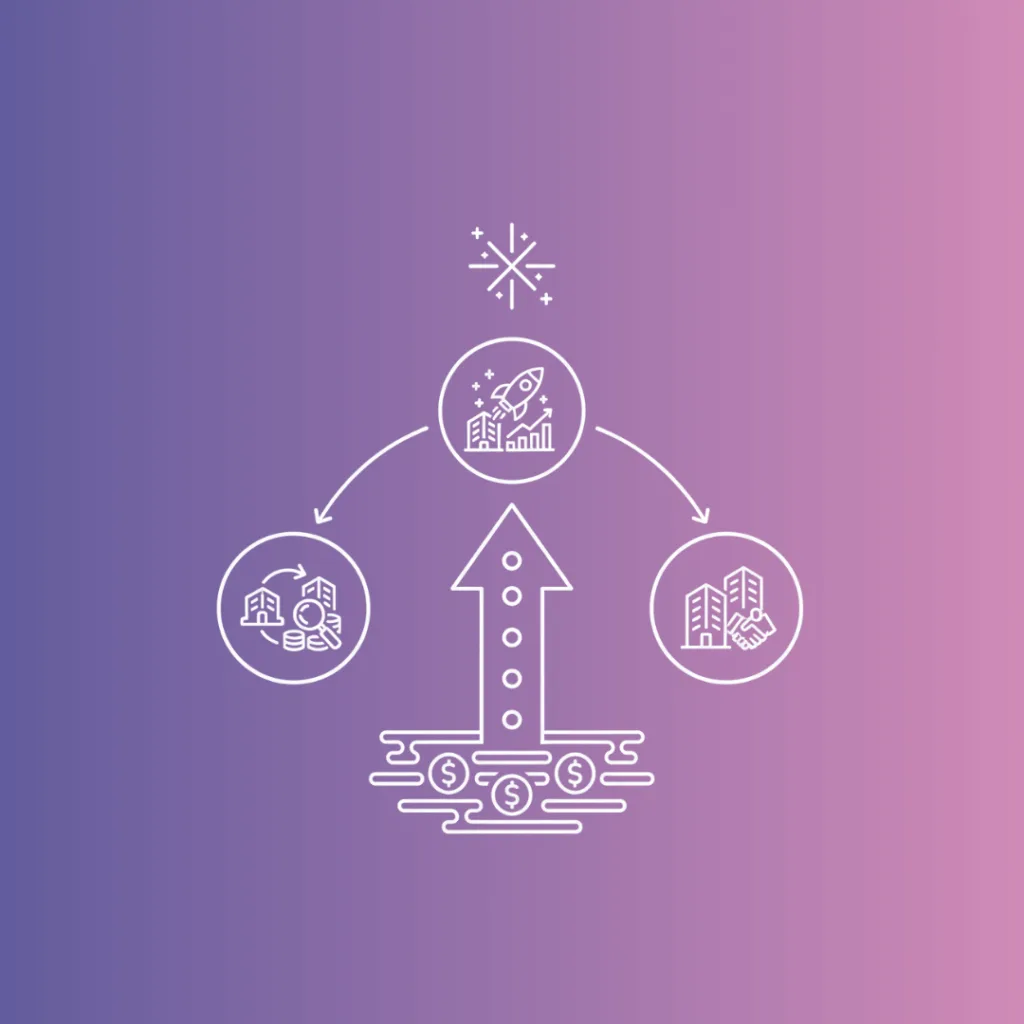

How Founder SPVs Help Startups Raise Capital and Scale Faster

Raising capital is often complex for founders. Between juggling multiple investors, managing endless admin, and keeping a clean cap table, fundraising can feel like a full-time job. That’s where Founder SPVs come in. By pooling investors into a single entity, they give startups a smarter way to raise money, simplify ownership, and keep future rounds […]

DPI is the new IRR

For years, IRR (Internal Rate of Return) has been the star metric in private market circles. But in today’s market, investors are starting to ask a different question: “How much cash have I actually gotten back?” That’s where DPI (Distributions to Paid-In Capital) in private market funds steps in as the real measure of performance. […]