From Syndicate to Fund: When It Makes Sense to Level Up Your Structure

A common question among repeat syndicate leads Many syndicate leads start with a simple question: “Should I just keep running SPVs, or is it time to launch a fund?” There is no universal threshold where a syndicate suddenly becomes a fund. Instead, the transition usually happens when operational complexity, investor expectations, and capital cadence begin […]

Small vs Large Funds: The 2025 Fundraising Split That Shapes 2026

Across private markets, LPs became more selective, liquidity remained uneven, and re-ups increasingly flowed to managers with proven systems. The result was a clear split: larger funds and established platforms continued to close, while smaller vehicles faced a tougher bar and longer timelines. This matters for 2026 because it changes the real question from “Is […]

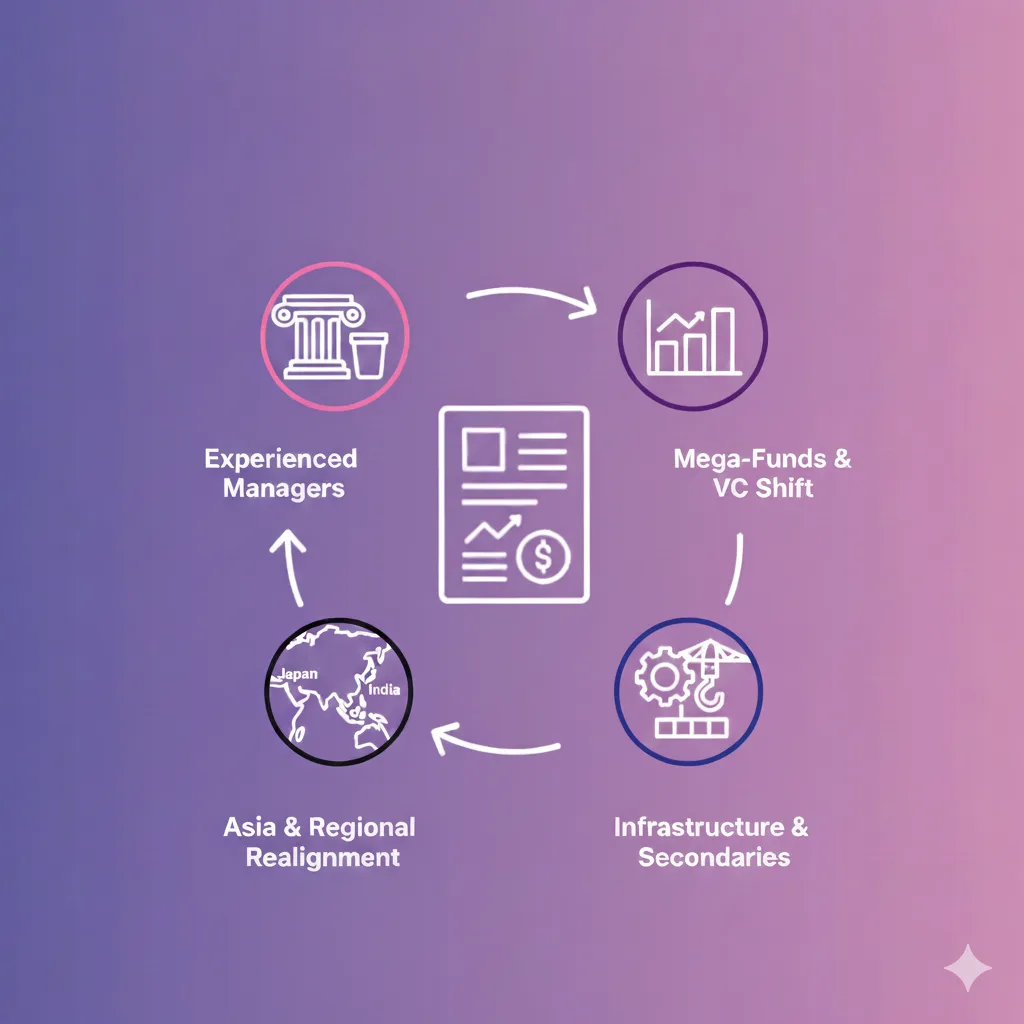

The Flight to Quality: Steering Through the 2025 Private Market Reset

The transition into 2026 represents one of the most significant structural shifts in the history of private capital. Global private markets are no longer operating under the speculative fervor of the early 2020s. Instead, they have entered a period of sober recalibration where capital is concentrated in the hands of the most proven operators. For […]

How to Communicate With LPs Throughout the Lifetime of an SPV

Keeping investors in the loop builds trust, confidence and long-term relationships. LP reporting transforms what seems like administrative overhead into an efficient way to show transparency, track progress and highlight the impact of every SPV investment. Capital calls, quarterly updates, post-exit summaries, and performance dashboards show how SPVs move through distinct stages where transparent LP […]

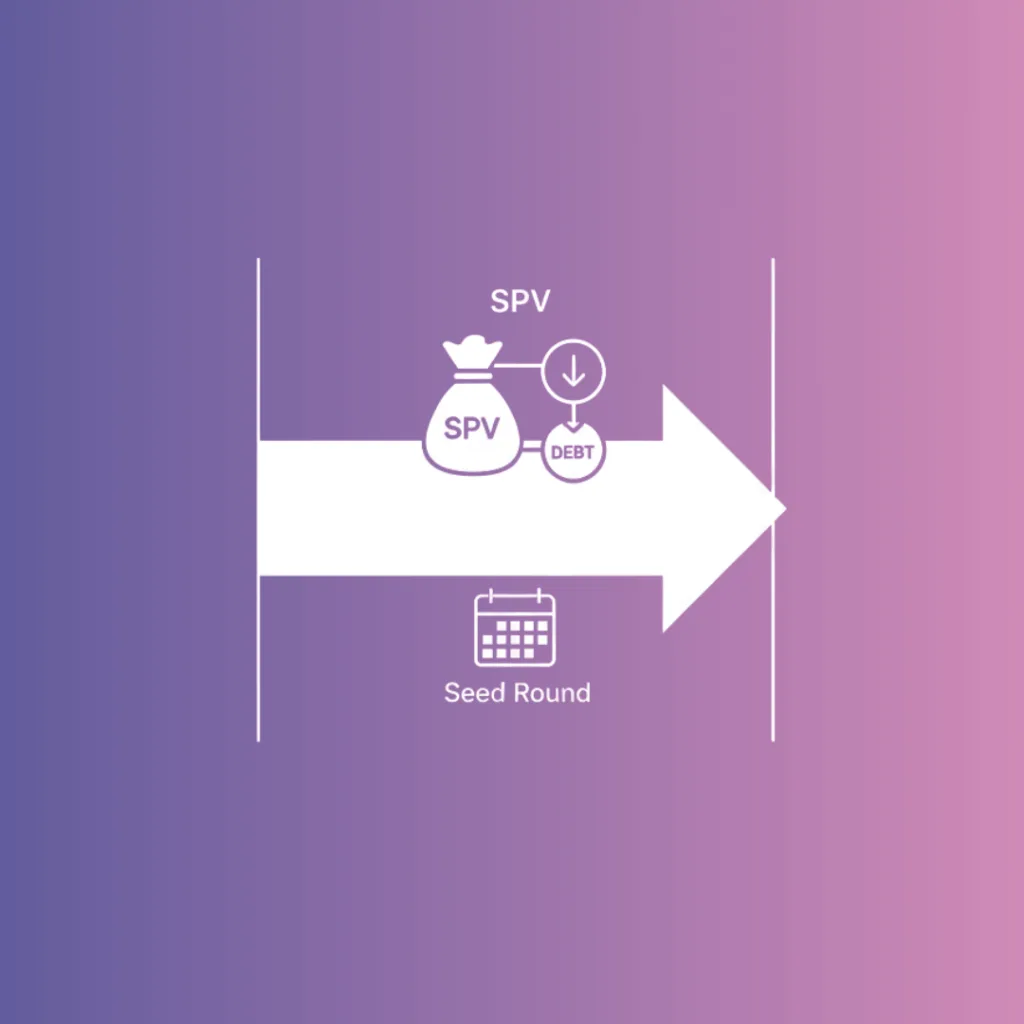

How Convertible Notes Work with SPVs in Early-Stage Angel Rounds

Convertible notes are the fast lane for early-stage angel investment, letting investors back startups without getting bogged down in valuations or complex equity terms. When routed through SPVs, they bring added efficiency, pooled capital, and strategic flexibility. Pooling capital via SPVs, navigating conversion timing, discounts, and valuation caps are just a few of the nuances […]

Where Asian Private Markets are Headed this 2026

Asia’s private markets trend for 2026 is shaping up to be both a rebound and a redesign. Liquidity is expanding, but it no longer flows only through IPO lanes but instead, private credit, secondaries and hybrid fund structures now shape outcomes. GPs, family offices and allocators who move fast on structure, liquidity engineering and cross-border […]

How Secondary Markets are Redefining Startup Liquidity in 2025

For years, the IPO has been the golden ticket. But in 2025, the tide has turned. Sophisticated secondary markets are intervening to give early employees, founders and investors the liquidity window they’ve been waiting for without relying on public markets that could take years to reopen. The private equity secondary market is becoming the pressure […]

Bridge Round Explained for Angel Investors Syndicates and Venture Funds

A bridge round used to be the private market’s quiet signal and a term often whispered only when a startup needed an extra six months of runway. But today, the capital landscape is more tactical and less linear, and this interim financing has transformed from a yellow flag to a valuable instrument for value creation. […]

Are VCs the New Investment Bankers Controlling Startup Liquidity?

Startup liquidity used to follow a predictable path. Raise capital, grow, and aim for an IPO or acquisition years down the road. But today’s market looks different. Exits are slower, private rounds stretch longer, and founders and early employees need liquidity long before an official exit, a shift that’s now fueling conversations about how VCs […]

What’s the Difference Between Venture Debt and Private Credit

Capital in private markets continues to evolve. Founders and investors now have more strategic ways to finance growth, and these two powerful financing options are gaining traction: venture debt and private credit. Both promise flexibility, faster access to funds, non-dilutive capital and less dependence on traditional banks, and yet they work very differently in practice. […]