How Much to Launch an SPV in Singapore and How Long It Takes

Launching a deal shouldn’t feel like starting a fund. Many investors now use SPVs, a faster and more flexible way to pool capital for a single opportunity. In Singapore, SPVs have become the go-to structure for cross-border syndicates and emerging fund managers seeking speed without incurring heavy setup costs or complexity. Still, one question always […]

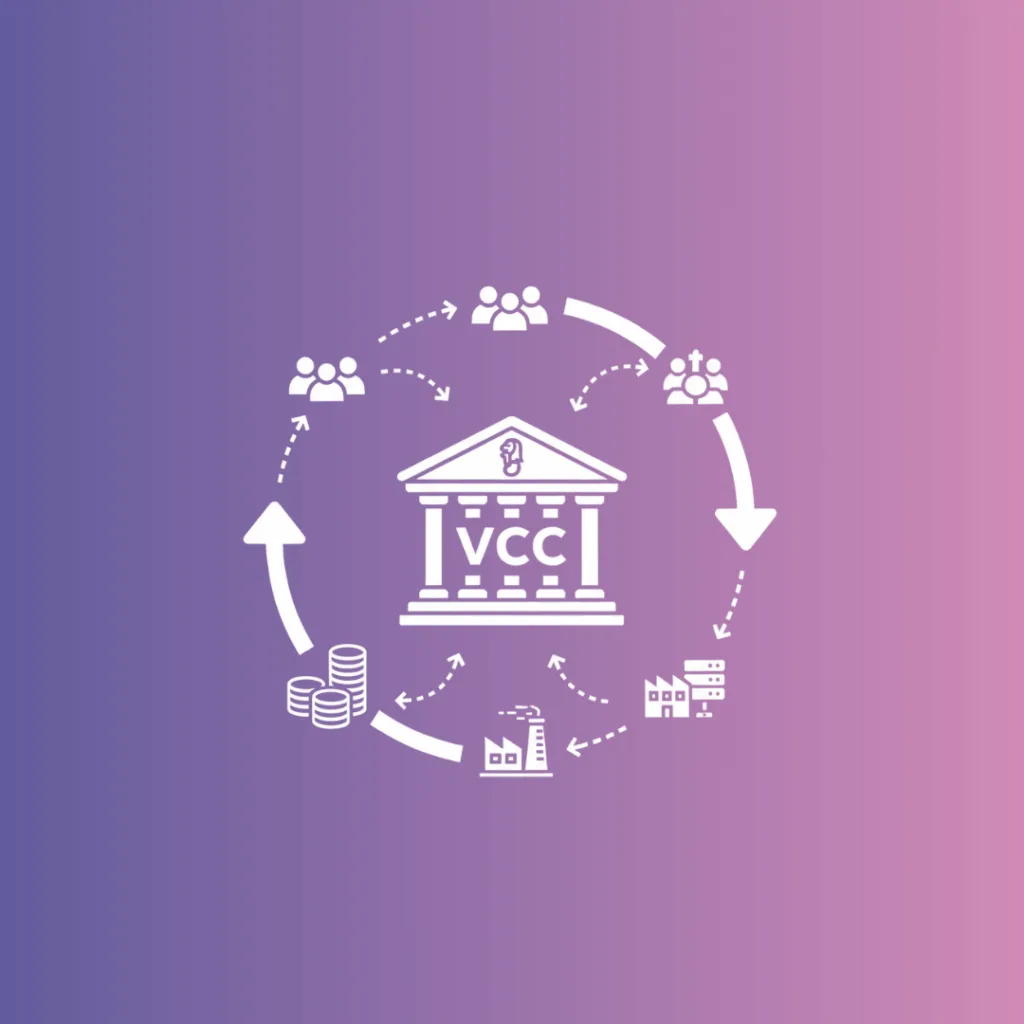

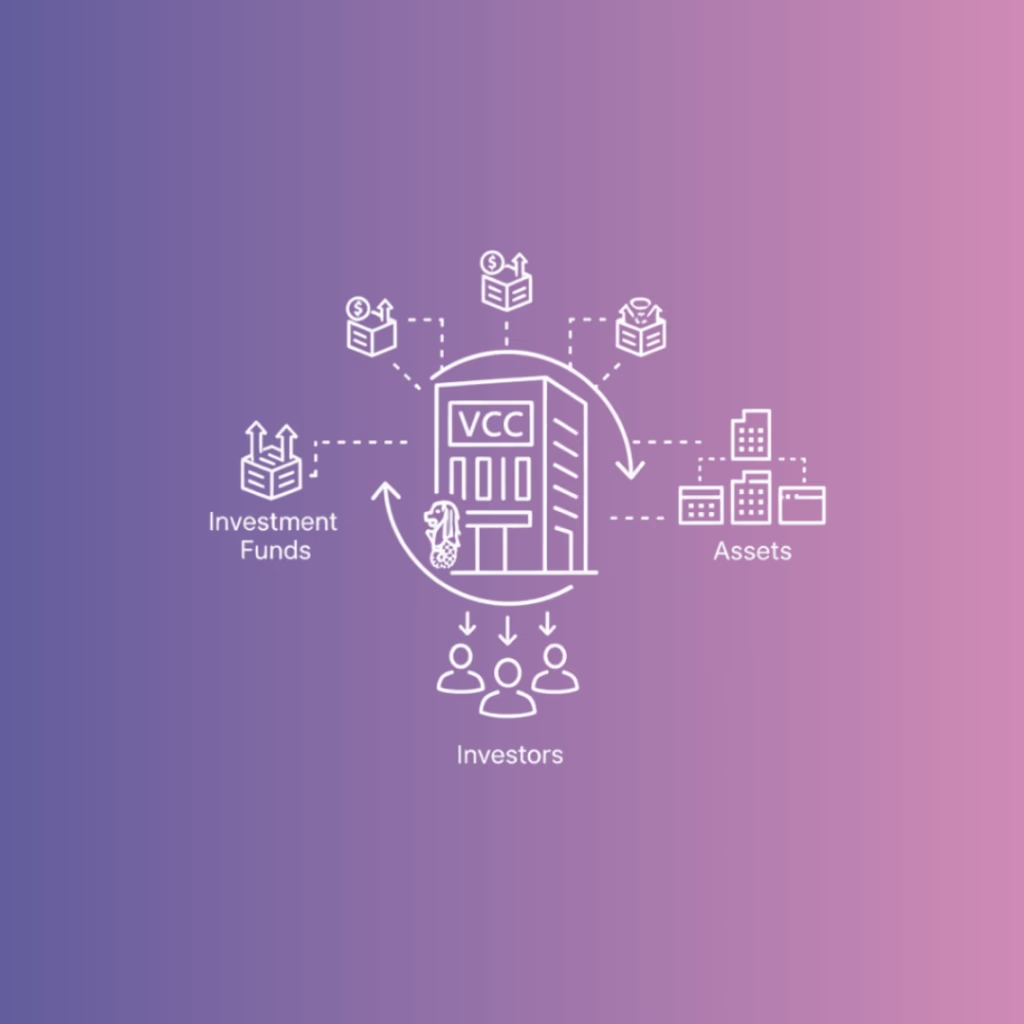

What is a VCC (Variable Capital Company) in Singapore? A beginner’s guide

In the modern fund structure landscape, flexibility, credibility, and efficiency matter, and that’s where the Singapore VCC (Variable Capital Company) comes to play, combining the sophistication of a regulated vehicle with the agility that fund managers, syndicate leads, and family offices need to operate globally. In this article, we’ll uncover what a VCC is, how […]

How to Set Up a Private Credit SPV?

In a market chasing yield and control, Private Credit SPVs (Special Purpose Vehicles) offer investors a clean, deal-by-deal way to lend, without the lock-ins or managerial drag associated with a large credit fund. If you want targeted exposure to private debt, clear liability ring-fencing, and simpler reporting, a Private Credit SPV is the legal wrapper […]

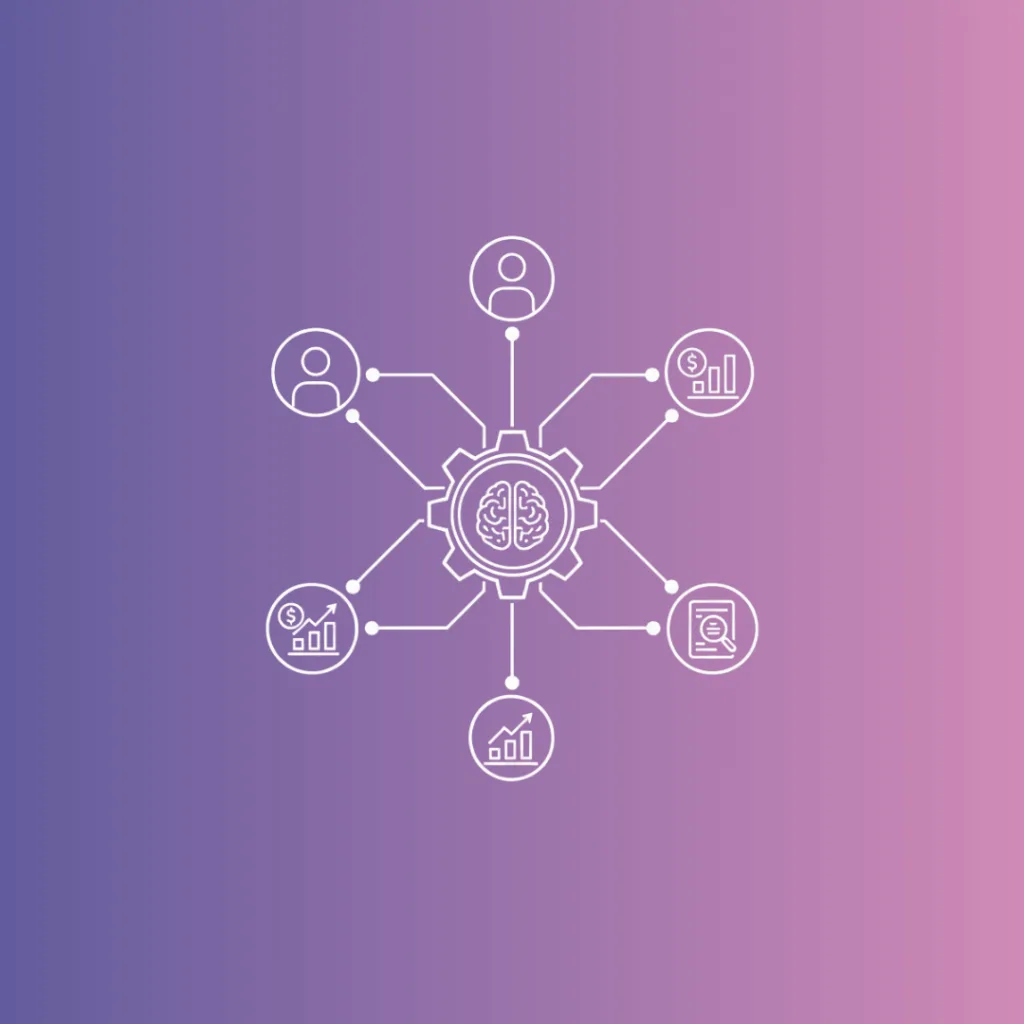

How AI in Fundraising is Powering Asia’s Next Wave of Venture Growth

AI is transforming the way capital is allocated and who has access to it. Across Asia’s private markets, a new kind of fundraising is emerging. Startups are raising leaner rounds but scaling faster. Fund managers are sourcing cross-border deals in days, not months. And syndicate leads are using AI in fundraising to spot high-potential founders […]

How Global Investors Access Singapore SPVs: The Complete Guide

Singapore is fast becoming the launchpad for global investors looking to tap into Asia’s thriving startup scene. Syndicate leads and angels abroad may often ask: Can non-Singaporean investors participate in Singapore SPVs? The answer is yes, and the process is more straightforward than many think. This article explains how SPVs for non-Singapore investors work, key […]

Singapore’s VCC is Powering the City-State’s Global Fund Leadership

Singapore is setting the pace and keeping up with global fund innovation. At the heart of this evolution is the VCC fund structure, a modern framework built for flexibility, speed, and global reach. Backed by a strong regulatory foundation and MAS support, the Variable Capital Company (VCC) gives fund managers the freedom to scale while […]

Is a Singapore SPV Tax-Efficient for Global Investors? The Full Analysis

Singapore has become one of the most attractive jurisdictions for structuring investments, primarily through the use of Special Purpose Vehicles (SPVs). For global investors, the draw goes beyond reputation. The real value lies in Singapore SPV’s tax efficiency. In this article, we examine how Singapore SPVs offer tax efficiency for global investors, highlighting their advantages, […]

What is a Debt SPV and How Does it Work?

A startup needs a quick bridge round. Instead of setting up a full-fledged fund, investors pool their capital into a lean, purpose-built vehicle that issues short-term loans. The deal gets done fast, risks stay contained, and everyone knows exactly where they stand. That’s the power of a Debt SPV. In this article, we’ll unpack what […]

Syndicate SPV: The Ultimate Tool for Angel Investors and Syndicate Leads

Angel investors know the best deals move fast, and the structure you use can make or break the experience. A Syndicate SPV (special purpose vehicle) simplifies startup investing by consolidating multiple investors into a single, streamlined entity, providing founders with a single cap table entry while reducing the administrative burden for all parties involved. For […]

How Angel Investors Use SPVs to Access Private Credit and Secondaries

Private markets are evolving fast, and angel investors no longer have to sit on the sidelines. With an SPV (special purpose vehicle) in private credit and secondaries, investors can access strategies once limited to institutions, such as direct lending and late-stage equity. In this guide, we’ll break down how SPVs open doors to private credit, […]