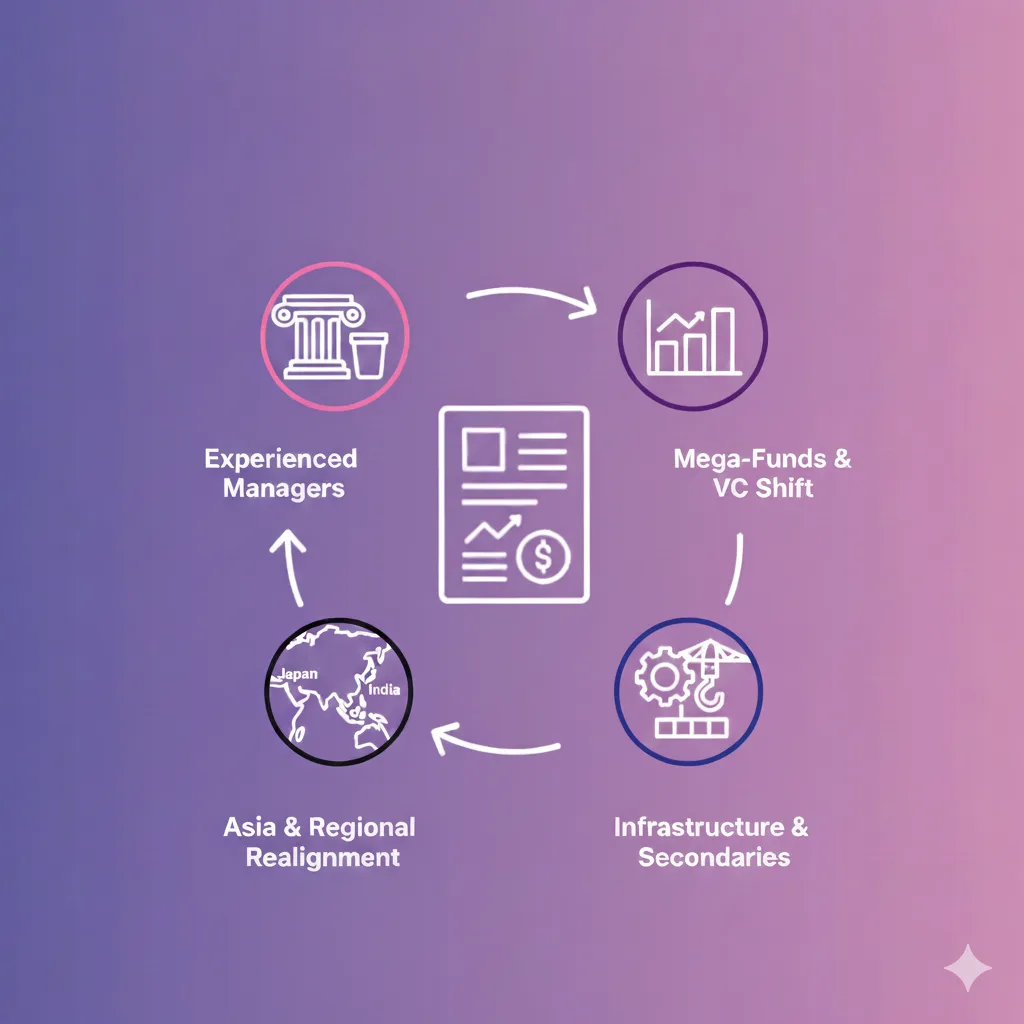

The transition into 2026 represents one of the most significant structural shifts in the history of private capital. Global private markets are no longer operating under the speculative fervor of the early 2020s. Instead, they have entered a period of sober recalibration where capital is concentrated in the hands of the most proven operators. For fund managers and founders, 2025 was a year of institutionalization where operational excellence became the primary metric for success.

The Chasm of Experience: Repeat vs. First-Time Managers

The most significant takeaway from 2025 is the near-total dominance of seasoned fund managers. Institutional investors have executed a sharp “flight to quality,” effectively narrowing the market for emerging managers.

Experienced Dominance: In the first half of 2025, 94.3 percent of all capital raised was allocated to experienced managers, defined as those who have raised four or more funds. These seasoned managers represented over three-quarters of the total number of funds raised by mid-year.

The First-Time Manager Struggle: Fundraising for the global venture capital industry hit an eight-year low in 2025, totaling $80.1 billion. This is a 38 percent decline from the $128.7 billion raised in 2024. In the Asia-Pacific region, the decline was even more dramatic: the number of first-time funds closed fell from 796 in 2017 to just 94 in 2024.

Liquidity Expectations: Limited Partners (LPs) are now prioritizing Distributions to Paid-In capital (DPI) over unrealized Internal Rates of Return (IRR). This shift has favored established managers with historical evidence of returning capital through multiple cycles.

The Concentration of Scale: Mega-Funds and the Barbell Effect

The market has bifurcated into a “barbell” structure. Capital is concentrated either in massive global mega-funds or highly specialized niche strategies.

The Momentum of Mega-Funds: In 2025, the 10 largest private equity funds collected $165 billion, or 22 percent of all capital raised globally for the asset class. Infrastructure fundraising was even more concentrated: the top 10 funds accounted for nearly half of all capital raised in that asset class.

Small Fund Economics: The average fund size for venture capital plummeted from $155 million in 2024 to $116.7 million in 2025. Managers of smaller funds (between $1 million and $10 million) typically have a higher median GP commitment of 2 percent compared to 1.5 percent for larger funds. Furthermore, LPs in smaller funds are twice as likely to be late in meeting capital calls, increasing the operational burden on emerging managers.

Strategic Pivots: From Growth to Stability

As interest rates remained higher for longer, the appetite for high-growth venture capital diminished in favor of asset classes that offer yield and downside protection.

Infrastructure Records: Infrastructure was the standout performer of 2025, reaching a record $289 billion raised.

Secondaries as Liquidity Tools: Global secondaries fundraising reached $130 billion, its strongest year on record. With the IPO window largely constrained, both GPs and LPs turned to the secondary market to manufacture liquidity. Secondaries accounted for 15 percent of all private equity fundraising, nearly double the five-year average.

Private Equity and Buyouts: Global private equity fundraising reached $735.3 billion in 2025, the lowest full-year total since 2020. Within this category, buyout deals grew to represent more than 50 percent of deal value in the Asia-Pacific region as investors sought greater control.

The Regional Realignment: The Asia Reset

While the aggregate numbers for Asia appear subdued, they reveal a dynamic realignment of capital within the region.

A Decade Low: Asia-Pacific-focused funds raised roughly $74 billion in 2025, a 10-year low. The region’s share of global fundraising fell to 6.3 percent, a precipitous drop from the 25.2 percent share recorded in 2018.

The Pivot to Japan and India: There is a pronounced strategic shift away from Greater China. Seven leading global fund managers closed almost twice as many deals in Japan and India in 2025 as they did during their historical averages between 2014 and 2018. Japan is increasingly recognized as a top developed market opportunity, driven by corporate carve-outs and a favorable regulatory environment.

Compliance as a Competitive Advantage

In the current funding environment, regulatory sophistication is a requirement for raising institutional capital. Managers are increasingly seeking streamlined domiciliation solutions that ensure compliance without excessive overhead.

Singapore: The Monetary Authority of Singapore (MAS) has strengthened governance standards for Variable Capital Companies (VCCs). Managers must now demonstrate substantive management to avoid being classified as “letterbox vehicles.” Circular IID 04/2025 emphasizes independent custody arrangements and active portfolio reviews.

UAE: The Abu Dhabi Global Market (ADGM) has introduced two new categories for 2026: Sub-Threshold Fund Managers (STFMs) and Institutional Fund Managers (IFMs). These regimes offer reduced governance requirements for managers with up to $200 million in committed capital, provided they maintain specific disclosure and capital requirements.

Cayman Islands: Effective January 1, 2026, the jurisdiction will implement CRS 2.0 and the Crypto Asset Reporting Framework (CARF). This extends reporting obligations to digital assets and requires all Cayman Financial Institutions to appoint a local Principal Point of Contact (PPoC).

As fund structures become more complex to meet these institutional standards, products like Nova: Fund-in-a-Box at Auptimate are helping managers handle the operational burden without sacrificing compliance or speed to market. To know more, you may book a call with us or get in touch with us at info@auptimate.com, and one of our experts will be more than happy to help.