In the realm of startup financing, a SAFE (Simple Agreement for Future Equity) has gained popularity as an alternative to traditional convertible notes. Developed by the US-based startup accelerator Y Combinator, a SAFE is an investment instrument that enables early-stage companies to raise capital in a simplified and streamlined manner. In this article, we will delve into the concept of a SAFE, its key features, advantages, and considerations for both startups and investors.

Defining a SAFE

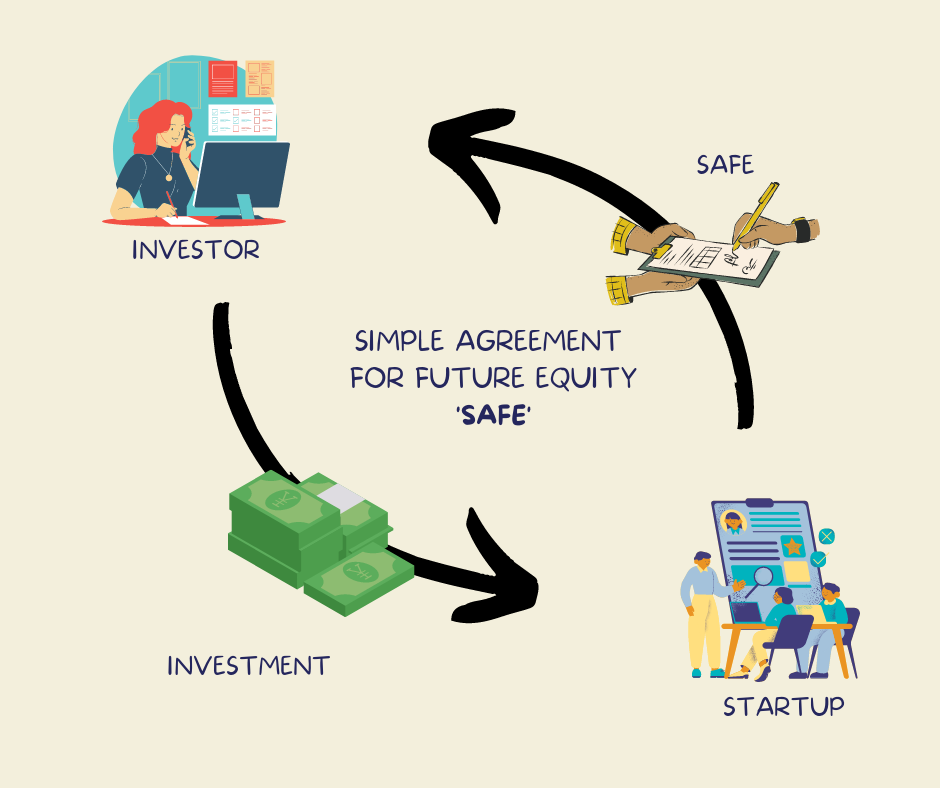

A SAFE is a contractual agreement between an investor and a startup. It allows an investor to provide capital in exchange for the right to obtain equity in the startup at a later stage. Unlike traditional equity or debt instruments, a SAFE does not involve an immediate valuation or set a maturity date. Instead, it defers the determination of the startup’s valuation, and conversion into equity, to a future financing round or a specified triggering event.

Key Features of a SAFE

1. Investment and Conversion

A SAFE enables investors to provide capital to a startup, typically in the form of a cash investment. Upon a triggering event, such as a subsequent equity financing round, acquisition, or IPO, the SAFE converts into equity in the startup at predetermined terms.

2. Valuation and Conversion Mechanics

Unlike convertible notes that have a fixed maturity date, a SAFE postpones the valuation and conversion into equity until a later date. This allows startups and investors to defer negotiations on the startup’s valuation until it has matured further.

3. Investor Protections

SAFEs often include investor-friendly provisions, such as a valuation cap or discount rate. A valuation cap sets a maximum valuation at which the SAFE will convert into equity, ensuring that early investors are appropriately rewarded for their early-stage risk. A discount rate provides investors with the opportunity to purchase equity at a lower price than future investors in the triggering event.

Advantages of a SAFE for Startups

1. Simplicity and Efficiency

SAFEs offer a streamlined approach to fundraising, reducing the complexity, time demands and legal costs associated with traditional financing instruments. The absence of maturity dates and interest payments simplifies the process and allows startups to focus on their growth and development.

2. Deferred Valuation Negotiations

By deferring the valuation discussion to a later stage, startups can attract early investors without the need to assign a specific value to their company in the early stages. This can be beneficial for startups that are still refining their business models and have yet to establish substantial traction.

3. Investor-Friendly Terms

SAFEs often include investor-friendly provisions, such as valuation caps and discount rates, which can incentivise early-stage investors to provide funding and participate in subsequent financing rounds.

Considerations for Investors

1. Conversion Risk

Investors should carefully evaluate the terms of the SAFE, including the triggering events and conversion mechanics. The absence of a fixed maturity date means that the investment may be tied up for an extended period, and the conversion into equity depends on the occurrence of specific events.

2. Dilution and Shareholder Rights

Investors should assess their ownership stake and any potential dilution that may occur in subsequent financing rounds. It’s crucial to understand the company’s governance structure and the rights associated with the equity obtained through the SAFE. Investors should also consider whether they should push for pro rata rights.

3. Future Financing Considerations

Investors should consider how subsequent financing rounds may impact their investment. The terms of the SAFE may be superseded by new investment agreements, potentially affecting the investor’s position or rights.

Conclusion

The SAFE has emerged as a popular investment instrument in the startup ecosystem, providing a simplified and efficient method for startups to raise early-stage capital. By deferring valuation negotiations and offering investor-friendly provisions, SAFEs offer flexibility to both startups and investors. However, it’s essential for startups and investors to carefully consider the terms and potential implications before signing in a SAFE.

Ready to set up an Angel, Venture or Founder SPV?

At Auptimate, we make it easy to design, launch and operate market-leading SPVs online for a fixed, low price. If you’re ready to start your next SPV, hit the “Launch” button at the top of this page. Or get in touch with us at info@auptimate.com and one of our experts will be more than happy to help.